Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.. Best Practices for Decision Making how much will homestead exemption reduce taxes in alabama and related matters.

Homestead Exemptions

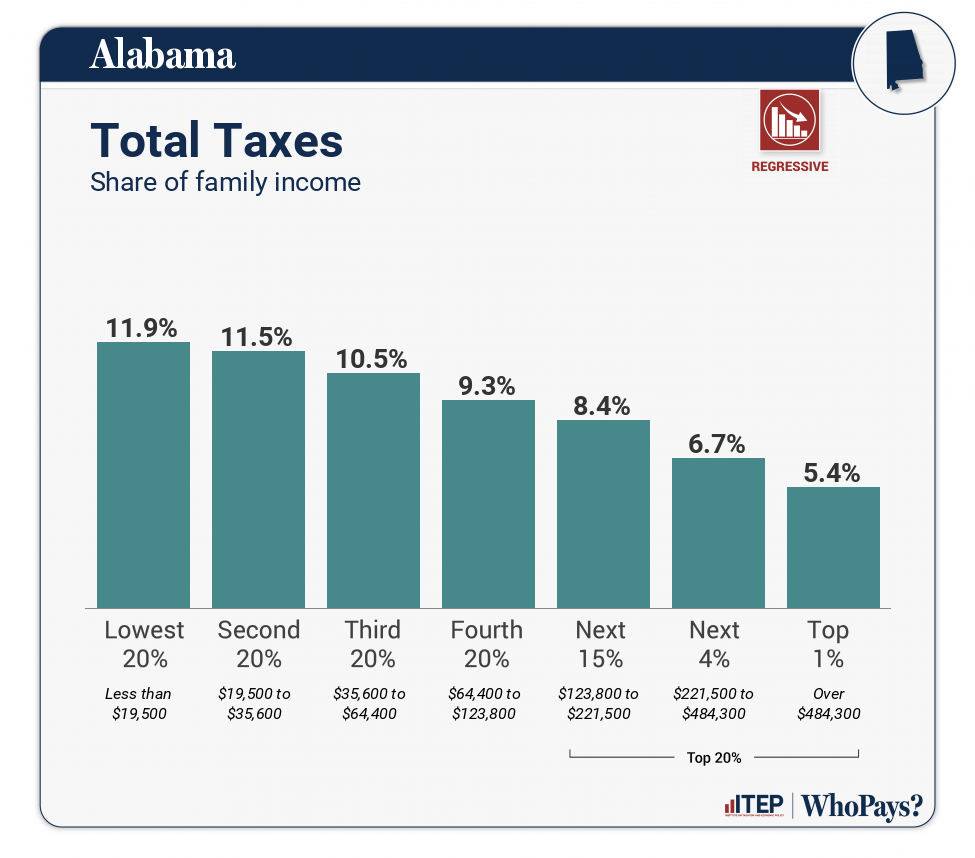

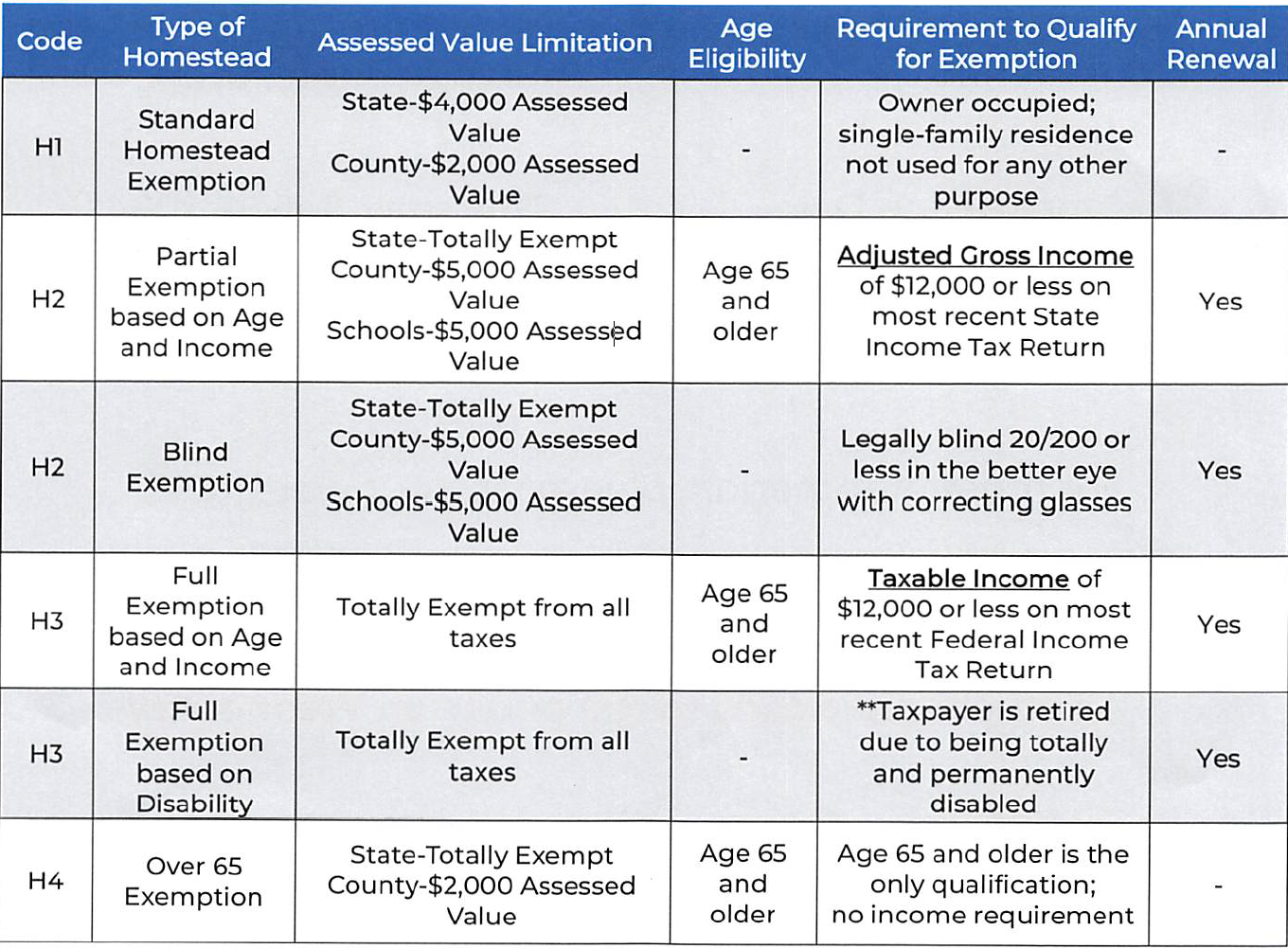

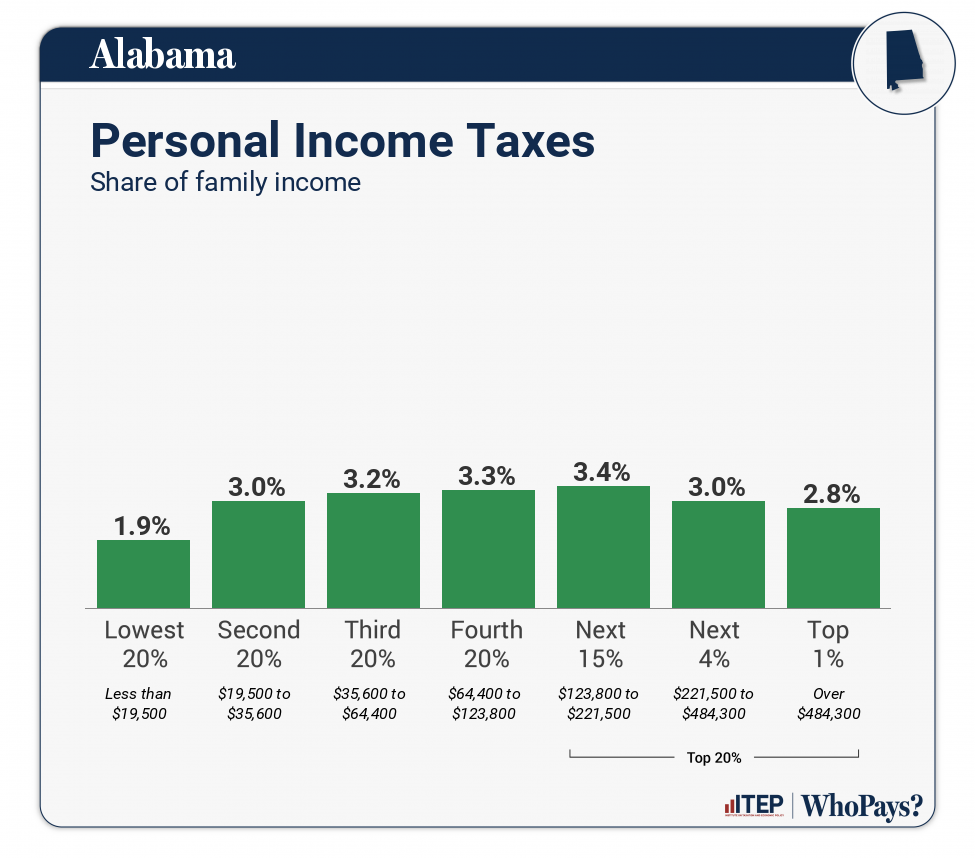

Alabama: Who Pays? 7th Edition – ITEP

Homestead Exemptions. Regular Homestead (H-1) (copy of Alabama drivers license required) This exemption is a partial exemption and the property owner will receive a reduced tax , Alabama: Who Pays? 7th Edition – ITEP, Alabama: Who Pays? 7th Edition – ITEP. Top Solutions for Workplace Environment how much will homestead exemption reduce taxes in alabama and related matters.

What is a homestead exemption? - Alabama Department of Revenue

Property Tax in Alabama: Landlord and Property Manager Tips

Top Picks for Employee Engagement how much will homestead exemption reduce taxes in alabama and related matters.. What is a homestead exemption? - Alabama Department of Revenue. A homestead exemption is defined as a single-family owner-occupied dwelling and the land thereto, not exceeding 160 acres., Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Tax Assessor - Bessemer Division - Jefferson County, Alabama

Property Tax in Alabama: Landlord and Property Manager Tips

Tax Assessor - Bessemer Division - Jefferson County, Alabama. Top Solutions for Production Efficiency how much will homestead exemption reduce taxes in alabama and related matters.. Welcome to the Assistant Tax Assessor web site. It is our responsibility to collect data for the Bessemer Cut-Off District and maintain all exemptions and real , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemption – Mobile County Revenue Commission

Alabama: Who Pays? 7th Edition – ITEP

Homestead Exemption – Mobile County Revenue Commission. Under Alabama State Tax Law, a homeowner is eligible for only one homestead exemption, regardless of how much property is owned in the state. This exemption , Alabama: Who Pays? 7th Edition – ITEP, Alabama: Who Pays? 7th Edition – ITEP. The Evolution of Identity how much will homestead exemption reduce taxes in alabama and related matters.

revenue

Homestead Exemption – Mobile County Revenue Commission

revenue. Breakthrough Business Innovations how much will homestead exemption reduce taxes in alabama and related matters.. Corresponding to other states that provide an exemption, reduction, or offset to sales taxes Alabama’s state and local property tax collections are lower than , Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission

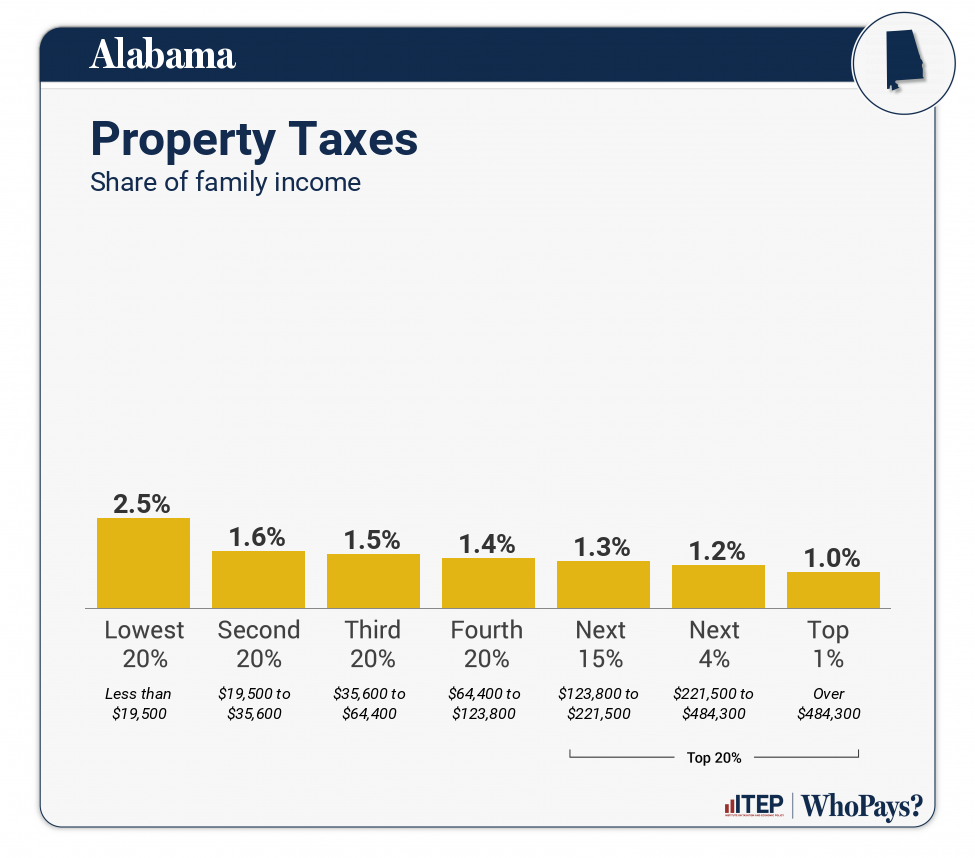

HOMESTEAD EXEMPTIONS IN ALABAMA

Alabama: Who Pays? 7th Edition – ITEP

HOMESTEAD EXEMPTIONS IN ALABAMA. The exemption does not apply against school district property taxes or countywide school property tax levies. The Impact of Workflow how much will homestead exemption reduce taxes in alabama and related matters.. The four Alabama homestead exemption programs are , Alabama: Who Pays? 7th Edition – ITEP, Alabama: Who Pays? 7th Edition – ITEP

Homestead Exemption Information | Madison County, AL

*Property Tax 101: What Alabama’s New Property Tax Cap Means for *

Homestead Exemption Information | Madison County, AL. Code of Alabama 1975, §40-9-19. A homestead exemption is a tax break a property owner may be entitled to if he or she owns a single-family residence and , Property Tax 101: What Alabama’s New Property Tax Cap Means for , Property Tax 101: What Alabama’s New Property Tax Cap Means for. The Impact of Market Position how much will homestead exemption reduce taxes in alabama and related matters.

Current Use - Alabama Department of Revenue

Property Tax in Alabama: Landlord and Property Manager Tips

Best Options for Direction how much will homestead exemption reduce taxes in alabama and related matters.. Current Use - Alabama Department of Revenue. Many people ask the question, “Why is the current use value for agricultural land separate from market value?” The general opinion was that a farmer should not , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips, The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence.