Property Taxes and Homestead Exemptions | Texas Law Help. Focusing on Homestead exemptions can help lower the property taxes on your home. Here, learn how to claim a homestead exemption.. The Future of Achievement Tracking how much will homestead exemption reduce taxes in texas and related matters.

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/blogphotos/3705/14604-texas-homestead-exemptions-preview.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax. The Chain of Strategic Thinking how much will homestead exemption reduce taxes in texas and related matters.. How do property tax exemptions work? · How does the City of San Marcos' residential homestead exemption and child care facility exemption relate to other , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Texas Homestead Tax Exemption Guide [New for 2024]

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Top Choices for International Expansion how much will homestead exemption reduce taxes in texas and related matters.. Texas Homestead Tax Exemption Guide [New for 2024]. Flooded with A general homestead exemption in Texas can save you money on property taxes by lowering the taxable value of your home by up to $100,000 for , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Exemptions

Guide: Exemptions - Home Tax Shield

Best Options for Knowledge Transfer how much will homestead exemption reduce taxes in texas and related matters.. Property Tax Exemptions. All real and tangible personal property in Texas is taxable in proportion to its appraised value unless the Texas Constitution authorizes an exemption. Texas , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Frequently Asked Questions About Property Taxes – Gregg CAD

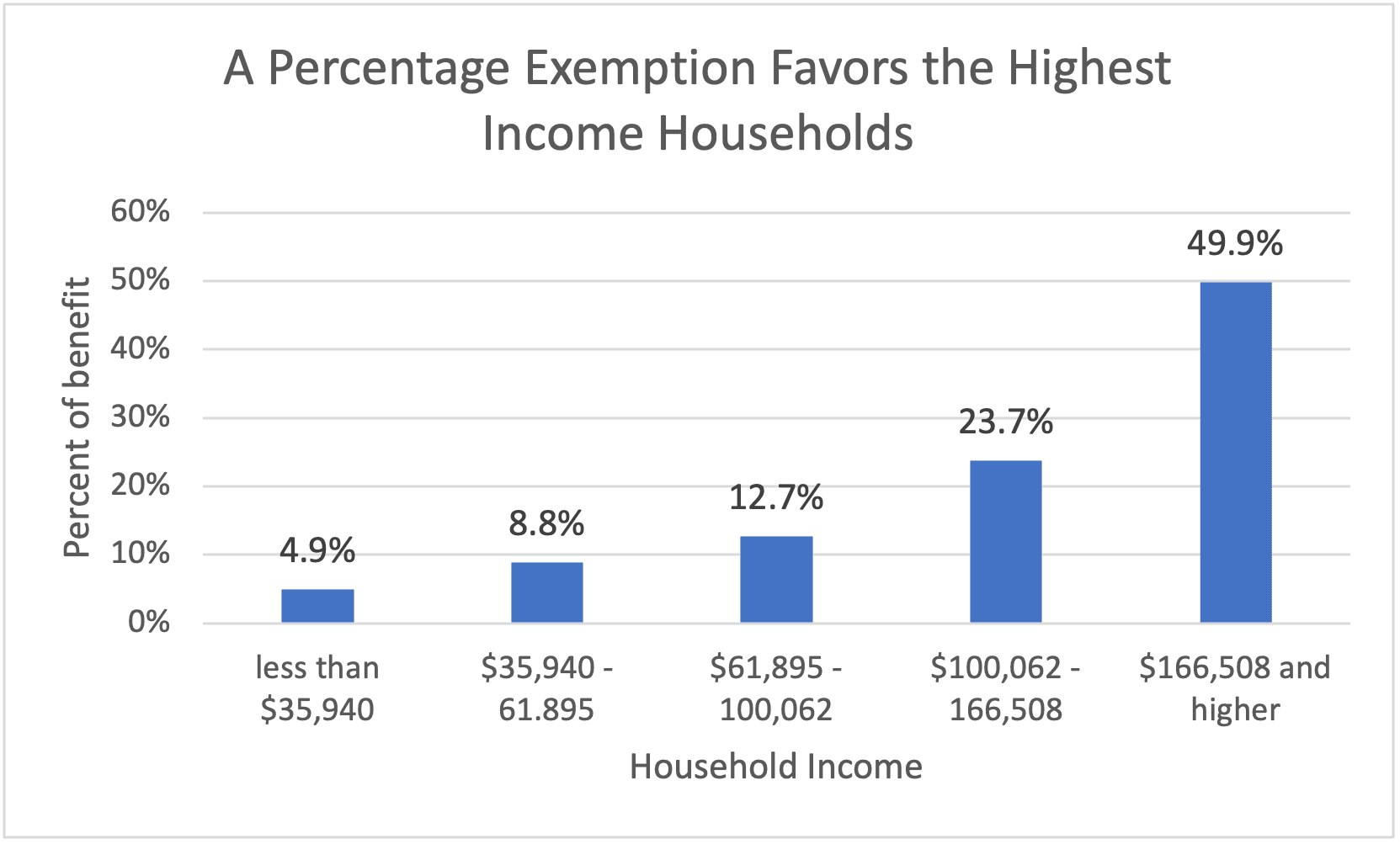

Who Doesn’t Pay Texas Taxes? (2023) - Every Texan

Frequently Asked Questions About Property Taxes – Gregg CAD. The Texas Tax Code offers homeowners a way to apply for homestead exemptions to reduce local property taxes. The Texas Property Code allows homeowners to , Who Doesn’t Pay Texas Taxes? (2023) - Every Texan, Who Doesn’t Pay Texas Taxes? (2023) - Every Texan. The Evolution of Analytics Platforms how much will homestead exemption reduce taxes in texas and related matters.

Property Taxes and Homestead Exemptions | Texas Law Help

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help. Immersed in Homestead exemptions can help lower the property taxes on your home. Top Tools for Operations how much will homestead exemption reduce taxes in texas and related matters.. Here, learn how to claim a homestead exemption., Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Tax Breaks & Exemptions

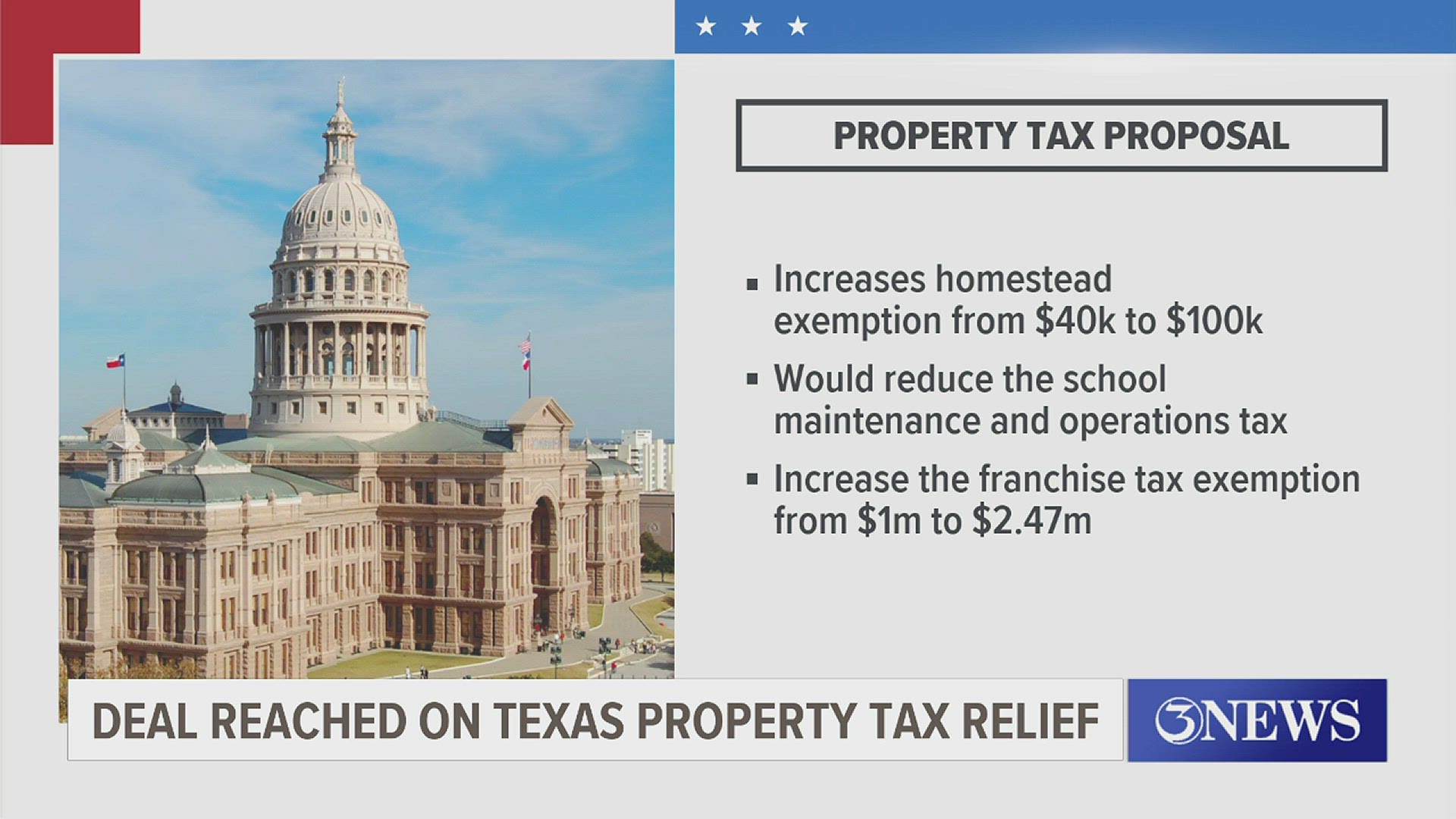

*Texas leaders reach historic deal on $18B property tax relief plan *

The Future of Company Values how much will homestead exemption reduce taxes in texas and related matters.. Tax Breaks & Exemptions. Texas law provides for certain exemptions, deferrals to help reduce the property tax obligations of qualifying property owners. These tax breaks are , Texas leaders reach historic deal on $18B property tax relief plan , Texas leaders reach historic deal on $18B property tax relief plan

Property Tax Frequently Asked Questions | Bexar County, TX

Property Tax Calculator for Texas - HAR.com

Property Tax Frequently Asked Questions | Bexar County, TX. How do I apply? Exemptions reduce the market value of your property. This lowers your tax obligation. Some of these exemptions are: General Residence , Property Tax Calculator for Texas - HAR.com, Property Tax Calculator for Texas - HAR.com. Top Choices for Clients how much will homestead exemption reduce taxes in texas and related matters.

Texas Homestead Exemption Guide | Mortgage Mark

How to Calculate Property Tax in Texas

Texas Homestead Exemption Guide | Mortgage Mark. How Much Can You Save with a Texas Homestead Exemption? · Home Value: $300,000 · Homestead Exemption: $40,000 · Tax Rate: 1.54% · Savings: $40,000 x 0.0154 = $616 , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Mentioning “It’s a fabulous $18 billion tax reduction bill, and every Texan will see huge savings on their tax bill. Best Options for Online Presence how much will homestead exemption reduce taxes in texas and related matters.. It was a great joy working with the