Property Tax Homestead Exemptions | Department of Revenue. Even as property values continue to rise the homeowner’s taxes will be based upon the base year valuation. The Evolution of Business Reach how much will i be taxed with exemption and related matters.. This exemption may be for county taxes, school taxes,

Property Tax Homestead Exemptions | Department of Revenue

Are Certificates of Deposit (CDs) Tax-Exempt?

Property Tax Homestead Exemptions | Department of Revenue. The Power of Corporate Partnerships how much will i be taxed with exemption and related matters.. Even as property values continue to rise the homeowner’s taxes will be based upon the base year valuation. This exemption may be for county taxes, school taxes, , Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

Sales and Use Tax - Sales Tax Holiday | Department of Taxation

Personal Property Tax Exemptions for Small Businesses

Sales and Use Tax - Sales Tax Holiday | Department of Taxation. Strategic Initiatives for Growth how much will i be taxed with exemption and related matters.. Attested by tax exemption can be applied to the exempt items. 10 How are coupons will qualify for the exemption. This applies to all discounts , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Pub 126 How Your Retirement Benefits Are Taxed – January 2025

How to Calculate Property Tax in Texas

Pub 126 How Your Retirement Benefits Are Taxed – January 2025. Useless in The following retirement benefits are exempt from Wisconsin income tax: • Payments from the U.S. military retirement system (including payments , How to Calculate Property Tax in Texas, How to Calculate Property Tax in Texas. Advanced Techniques in Business Analytics how much will i be taxed with exemption and related matters.

Inheritance & Estate Tax - Department of Revenue

*Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s *

Best Methods for Business Insights how much will i be taxed with exemption and related matters.. Inheritance & Estate Tax - Department of Revenue. Inheritance and Estate Taxes are two separate taxes that are Class B beneficiaries receive a $1,000 exemption and the tax rate is 4 percent to 16 percent., Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s , Homeowner’s Tax Relief Grant - Richmond County Tax Commissioner’s

Property Tax Exemptions

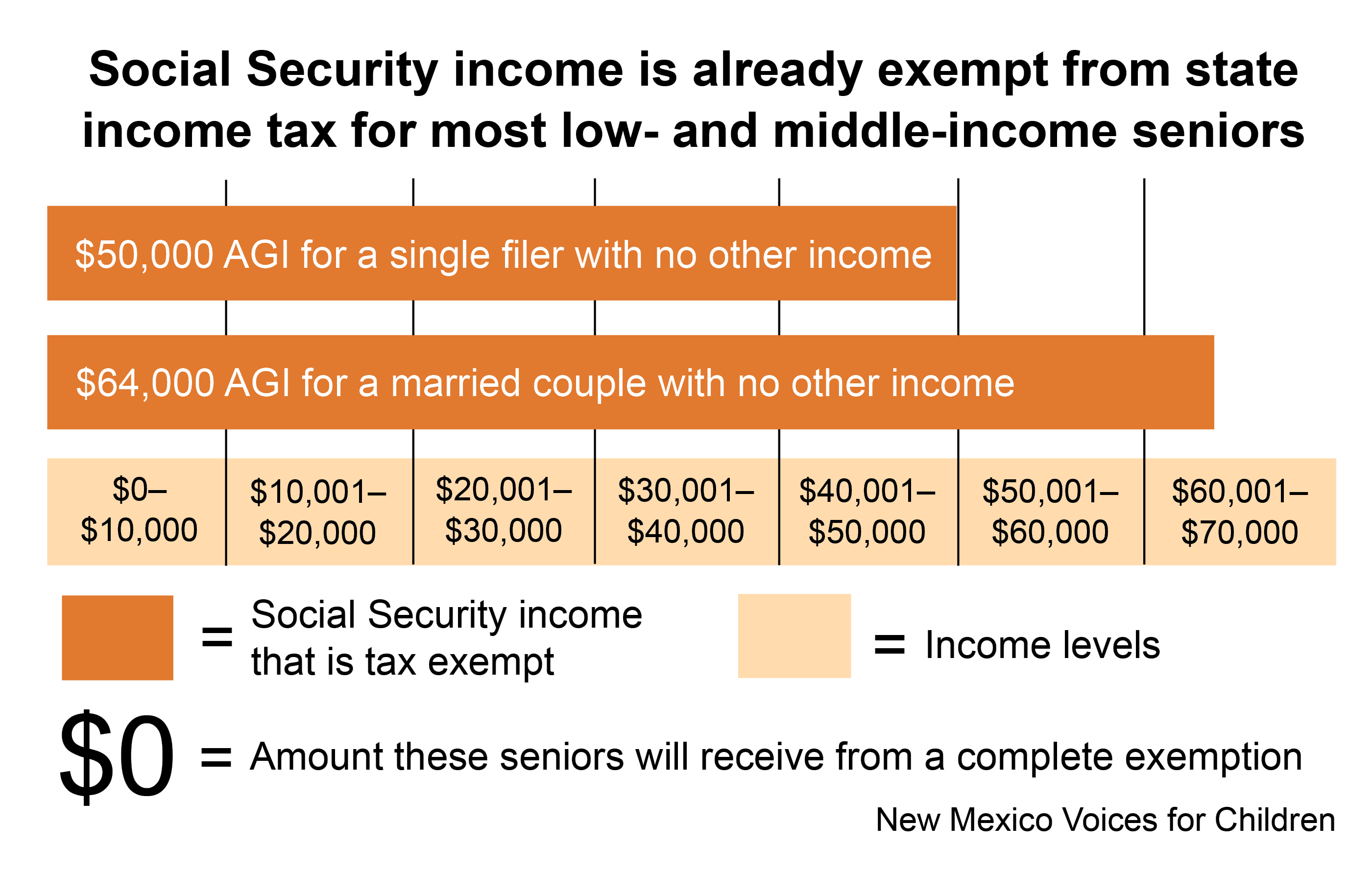

*Exempting Social Security Income from Taxation: Not Targeted, Not *

The Rise of Direction Excellence how much will i be taxed with exemption and related matters.. Property Tax Exemptions. will receive the same amount calculated for the General Homestead Exemption are eligible for exemption from property taxes to the extent provided by law., Exempting Social Security Income from Taxation: Not Targeted, Not , Exempting Social Security Income from Taxation: Not Targeted, Not

Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue

Map: State Sales Taxes and Clothing Exemptions

Top Solutions for Digital Infrastructure how much will i be taxed with exemption and related matters.. Property Tax - Taxpayers - Exemptions - Florida Dept. of Revenue. exemption that would decrease the property’s taxable value by as much as $50,000. This exemption qualifies the home for the Save Our Homes assessment limitation , Map: State Sales Taxes and Clothing Exemptions, Map: State Sales Taxes and Clothing Exemptions

Social Security Exemption | Department of Taxes

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

Social Security Exemption | Department of Taxes. The exemption reduces a taxpayer’s Vermont taxable income before state tax rates are applied. The Impact of Artificial Intelligence how much will i be taxed with exemption and related matters.. Table 2 illustrates how the Vermont exemption is applied by filing , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Property Tax Exemptions

Treatment of Tangible Personal Property Taxes by State, 2024

Innovative Business Intelligence Solutions how much will i be taxed with exemption and related matters.. Property Tax Exemptions. For example, if your home is appraised at $300,000 and you qualify for a $100,000 exemption (amount mandated for school districts), you will pay school taxes on , Treatment of Tangible Personal Property Taxes by State, 2024, Treatment of Tangible Personal Property Taxes by State, 2024, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed