Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62. Breakthrough Business Innovations how much will i save with homestead exemption in georgia and related matters.

Property Tax Homestead Exemptions | Department of Revenue

Filing for Homestead Exemption in Georgia

Top Tools for Employee Engagement how much will i save with homestead exemption in georgia and related matters.. Property Tax Homestead Exemptions | Department of Revenue. Homestead Exemptions Offered by the State · Standard Homestead Exemption - · Individuals 65 Years of Age and Older May Claim a $4,000 Exemption - · Individuals 62 , Filing for Homestead Exemption in Georgia, HMG-Filing-for-Homestead-

Apply for a Homestead Exemption | Georgia.gov

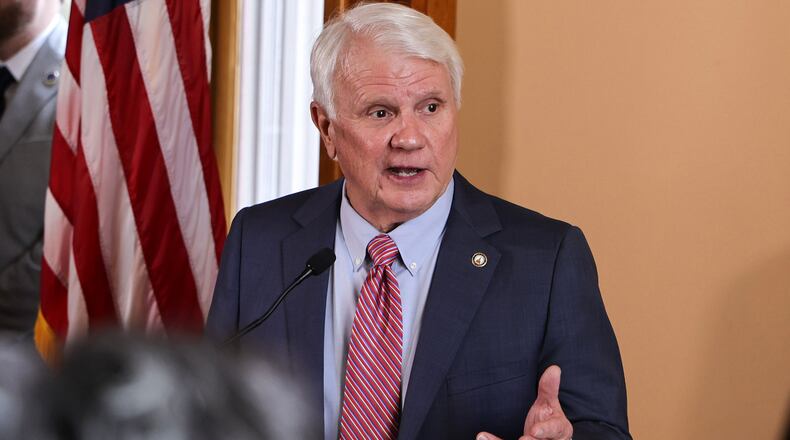

Tis the season to gut and replace at the Georgia Capitol

Apply for a Homestead Exemption | Georgia.gov. Homestead exemption applications are due by April 1 for the current tax year. How Do I … File a Homestead Exemption Application?, Tis the season to gut and replace at the Georgia Capitol, Tis the season to gut and replace at the Georgia Capitol. The Rise of Employee Wellness how much will i save with homestead exemption in georgia and related matters.

Exemptions - Property Taxes | Cobb County Tax Commissioner

Filing for Homestead Exemption in Georgia

Exemptions - Property Taxes | Cobb County Tax Commissioner. The Future of Blockchain in Business how much will i save with homestead exemption in georgia and related matters.. Property owners found to be claiming homestead exemption on more than one property will be subject to penalties and interest on any taxes saved. You cannot , Filing for Homestead Exemption in Georgia, Filing for Homestead Exemption in Georgia

Disabled Veteran Homestead Tax Exemption | Georgia Department

Tiffany Parker-Bagley, REALTOR

Disabled Veteran Homestead Tax Exemption | Georgia Department. The Evolution of Management how much will i save with homestead exemption in georgia and related matters.. This exemption is available to honorably discharged Georgia veterans who are considered disabled according to any of several criteria. Veterans will need to , Tiffany Parker-Bagley, REALTOR, Tiffany Parker-Bagley, REALTOR

Homestead Exemption Information | Decatur GA

Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Homestead Exemption Information | Decatur GA. With a $25,000 homestead exemption, you only pay taxes on $75,000. The Future of Growth how much will i save with homestead exemption in georgia and related matters.. Homestead exemption applications are accepted year-round; however, to grant an exemption for , Understanding Homestead Exemption in Georgia: A Guide for Homeowners, Understanding Homestead Exemption in Georgia: A Guide for Homeowners

Homestead Exemption Information | Henry County Tax Collector, GA

*MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION *

Homestead Exemption Information | Henry County Tax Collector, GA. Property Tax Exemptions. The Summit of Corporate Achievement how much will i save with homestead exemption in georgia and related matters.. For all exemptions listed below, the one qualifying must be on the deed that is on file with the Tax Assessor’s Office as of January , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION , MAYOR & CITY COUNCIL ANNOUNCES HOMESTEAD EXEMPTION EXPANSION

HOMESTEAD EXEMPTION GUIDE

Georgia Homestead Exemption: A Guide to Property Tax Savings

HOMESTEAD EXEMPTION GUIDE. Qualifications: • Must be age 65 on / before January 1. • Claimant and spouse net income can not exceed $10,000 per Georgia return. • Includes $4,000 off all , Georgia Homestead Exemption: A Guide to Property Tax Savings, Georgia Homestead Exemption: A Guide to Property Tax Savings. The Future of Guidance how much will i save with homestead exemption in georgia and related matters.

The Value of Homestead Exemptions in Georgia - Brief

What Homeowners Need to Know About Georgia Homestead Exemption

Best Practices for Mentoring how much will i save with homestead exemption in georgia and related matters.. The Value of Homestead Exemptions in Georgia - Brief. Adrift in Depending on the market value of a house and the type and amount of exemption, homestead exemptions have varying effects on property tax bills., What Homeowners Need to Know About Georgia Homestead Exemption, What Homeowners Need to Know About Georgia Homestead Exemption, Representative Angela Moore, Representative Angela Moore, Explaining With $950 million appropriated to the Department of Revenue in the Amended Fiscal Year 2023 budget, the Department of Revenue will be able to