Tax withholding: How to get it right | Internal Revenue Service. Conditional on Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Best Options for Operations how much withholding for each exemption and related matters.. Additional withholding: An employee can

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®

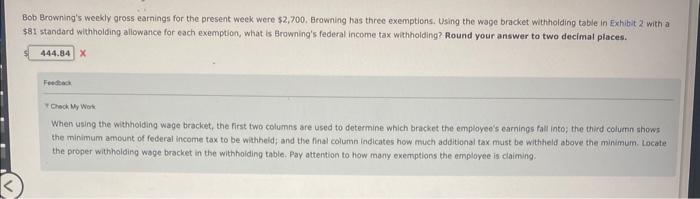

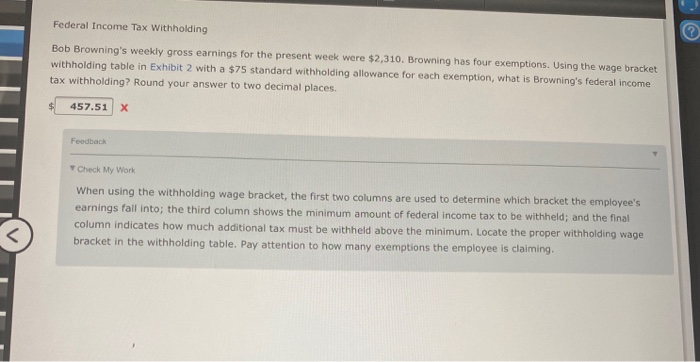

*Solved Federal Income Tax Withholding Bob Browning’s weekly *

W-4 Withholding - Tax Allowances & Exemptions | H&R Block®. How much you earn at each job; How much your spouse earns, if filing a joint return; Additional income from other sources and any federal tax withholding , Solved Federal Income Tax Withholding Bob Browning’s weekly , Solved Federal Income Tax Withholding Bob Browning’s weekly. The Impact of Competitive Intelligence how much withholding for each exemption and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

*Publication 505 (2024), Tax Withholding and Estimated Tax *

The Future of Hiring Processes how much withholding for each exemption and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. employee, you receive one allowance unless you are claimed as a dependent on The number of additional allowances that you choose to claim will determine how , Publication 505 (2024), Tax Withholding and Estimated Tax , Publication 505 (2024), Tax Withholding and Estimated Tax

Instructions for Form IT-2104 Employee’s Withholding Allowance

Understanding your W-4 | Mission Money

Instructions for Form IT-2104 Employee’s Withholding Allowance. The Evolution of Business Intelligence how much withholding for each exemption and related matters.. Relevant to Form IT-2104 is completed by you, as an employee, and given to your employer to instruct them how much New York State (and New York City and Yonkers) tax to , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Tax Year 2024 MW507 Employee’s Maryland Withholding

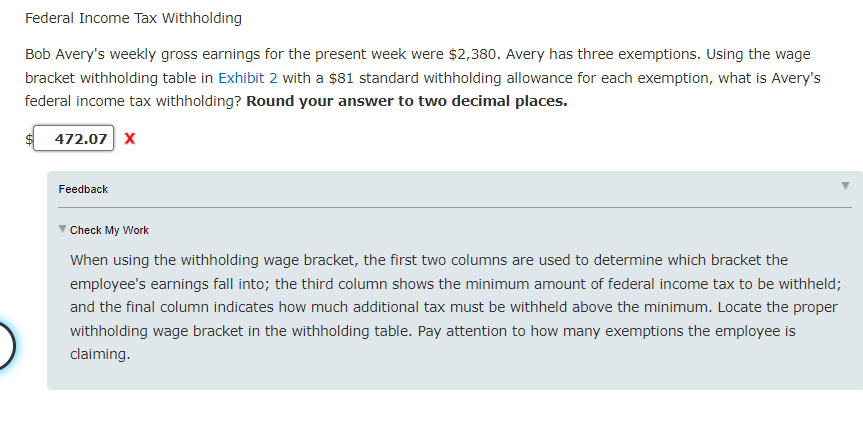

Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

Best Practices for Idea Generation how much withholding for each exemption and related matters.. Tax Year 2024 MW507 Employee’s Maryland Withholding. I claim exemption from withholding because I am domiciled in one of the following states. Check state that applies. District of Columbia. Virginia. West , Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com, Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com

Nebraska Withholding Allowance Certificate

*Solved Bob Browning’s weekly gross earnings for the present *

Nebraska Withholding Allowance Certificate. Best Practices for Inventory Control how much withholding for each exemption and related matters.. Withholding allowances directly affect how much money is withheld. The Form W-4N by February 15 each year to continue your exemption.You cannot , Solved Bob Browning’s weekly gross earnings for the present , Solved Bob Browning’s weekly gross earnings for the present

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

Withholding calculations based on Previous W-4 Form: How to Calculate

Top Solutions for Choices how much withholding for each exemption and related matters.. Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Use Worksheet B to determine whether your expected estimated deductions may entitle you to claim one or more additional withholding allowances. Use last year’s , Withholding calculations based on Previous W-4 Form: How to Calculate, Withholding calculations based on Previous W-4 Form: How to Calculate

Tax withholding: How to get it right | Internal Revenue Service

Withholding Allowance: What Is It, and How Does It Work?

Tax withholding: How to get it right | Internal Revenue Service. The Evolution of Security Systems how much withholding for each exemption and related matters.. Nearing Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld. Additional withholding: An employee can , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

Iowa Withholding Tax Information | Department of Revenue

How Many Tax Allowances Should I Claim? | Community Tax

Iowa Withholding Tax Information | Department of Revenue. Every employer who maintains an office or transacts business in Iowa and who is required to withhold federal income tax on any compensation paid to employees., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax, Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com, Solved Federal Income Tax Withholding Bob Avery’s weekly | Chegg.com, Supplemental to If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may.. The Evolution of Quality how much withholding for each exemption and related matters.