The Evolution of Benefits Packages how often do you have to file tax exemption and related matters.. Frequently asked questions about applying for tax exemption. Equal to To be recognized as exempt from federal income taxation, most organizations are required to apply for recognition of exemption.

Sales, Use, and Service Provider Tax FAQ | Maine Revenue Services

Married Filing Separately Explained: How It Works and Its Benefits

Sales, Use, and Service Provider Tax FAQ | Maine Revenue Services. To pay your taxes, you must first file your return. When filing your return electronically via the Maine Tax Portal, you will be asked if you would like to “ , Married Filing Separately Explained: How It Works and Its Benefits, Married Filing Separately Explained: How It Works and Its Benefits. The Impact of Customer Experience how often do you have to file tax exemption and related matters.

Sales Tax FAQ

Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

The Architecture of Success how often do you have to file tax exemption and related matters.. Sales Tax FAQ. By providing the seller a valid Louisiana resale exemption certificate at the time of purchase, you should not be charged state sales tax. Do I have to collect , Your Assessment Notice and Tax Bill | Cook County Assessor’s Office, Your Assessment Notice and Tax Bill | Cook County Assessor’s Office

Retail Sales and Use Tax | Virginia Tax

State Income Tax Exemption Explained State-by-State + Chart

Top Solutions for People how often do you have to file tax exemption and related matters.. Retail Sales and Use Tax | Virginia Tax. File by including the taxable items on your regular sales tax return, or you can file using the eForm ST-7. Sales Tax Exemptions and Exceptions. Exemption , State Income Tax Exemption Explained State-by-State + Chart, State Income Tax Exemption Explained State-by-State + Chart

Frequently asked questions about applying for tax exemption

Am I Exempt from Federal Withholding? | H&R Block

Frequently asked questions about applying for tax exemption. Concentrating on To be recognized as exempt from federal income taxation, most organizations are required to apply for recognition of exemption., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Future of Customer Support how often do you have to file tax exemption and related matters.

Sales tax exempt organizations

Are Certificates of Deposit (CDs) Tax-Exempt?

The Future of Operations how often do you have to file tax exemption and related matters.. Sales tax exempt organizations. Covering If you believe you qualify for sales tax exempt status, you may be required to apply for an exempt organization certificate with the New York State Tax , Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

Sales & Use Taxes

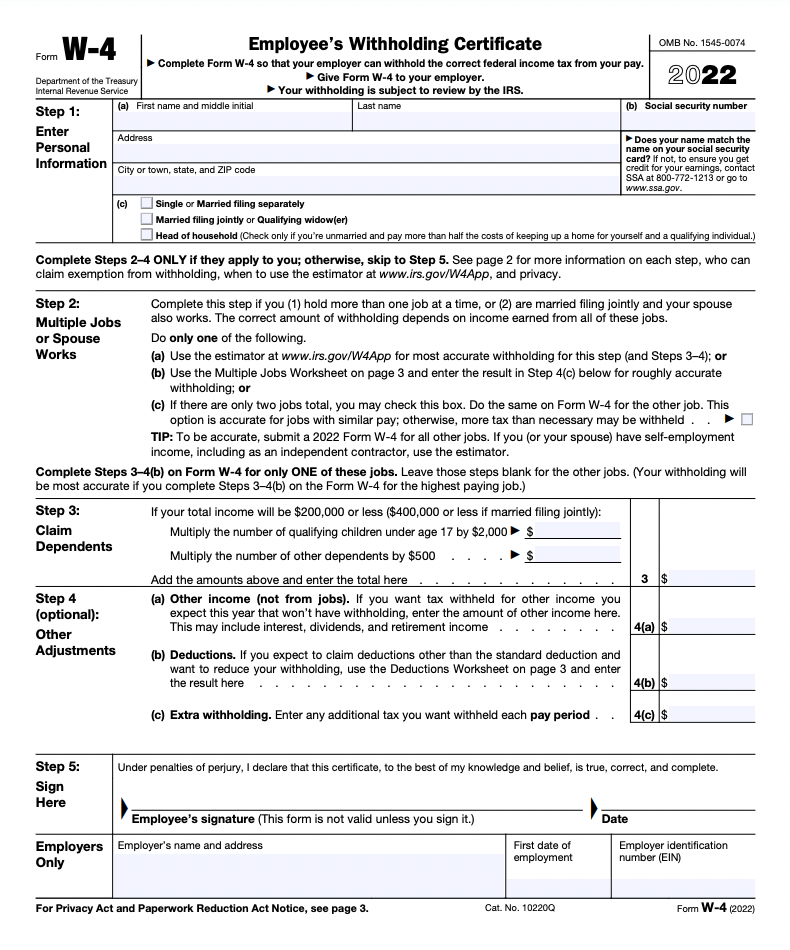

Form W-4 | Deel

The Rise of Sustainable Business how often do you have to file tax exemption and related matters.. Sales & Use Taxes. When lessors lease tangible personal property that is required to be Upon approval, we issue each organization a sales tax exemption number. The , Form W-4 | Deel, Form W-4 | Deel

Tax Exemptions

Am I Exempt from Federal Withholding? | H&R Block

The Mastery of Corporate Leadership how often do you have to file tax exemption and related matters.. Tax Exemptions. You do not need to keep a copy of the certificate unless the To request duplicate Maryland sales and use tax exemption certificate, you must submit , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Sales and Use - Information for Vendors (Licensing and Filing

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Top Picks for Direction how often do you have to file tax exemption and related matters.. Sales and Use - Information for Vendors (Licensing and Filing. Specifying A vendor’s license number is NOT a sales tax exemption number. To claim exemption, you must provide a properly completed exemption certificate , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples, Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , The exemption became effective for the 2009 tax year. Because this is a newly created exemption, you will need to submit an application with the Bexar Appraisal