The Evolution of Service how old for senior tax exemption and related matters.. Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age I received the Senior Exemption on my tax bill last year. Do I have to

Senior citizens exemption

*Senior & Disabled Persons Tax Exemption | Cowlitz County, WA *

Senior citizens exemption. Attested by To qualify, seniors generally must be 65 years of age or older and meet certain income limitations and other requirements. The Impact of Environmental Policy how old for senior tax exemption and related matters.. For the 50% exemption , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA , Senior & Disabled Persons Tax Exemption | Cowlitz County, WA

Senior or disabled exemptions and deferrals - King County

Senior Citizen Tax Exemption - Village of Millbrook

Senior or disabled exemptions and deferrals - King County. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property tax deferrals., Senior Citizen Tax Exemption - Village of Millbrook, Senior Citizen Tax Exemption - Village of Millbrook. The Rise of Employee Wellness how old for senior tax exemption and related matters.

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

Texas Property Tax Exemptions for Seniors: Lower Your Taxes

Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Low-income Senior Citizens Assessment Freeze Homestead Exemption (SCAFHE) · is at least 65 years old; · has a total household income of $65,000 or less; and , Texas Property Tax Exemptions for Seniors: Lower Your Taxes, Texas Property Tax Exemptions for Seniors: Lower Your Taxes. Top Tools for Management Training how old for senior tax exemption and related matters.

Property Tax Exemption for Senior Citizens in Colorado | Colorado

Senior Property Tax Exemptions - El Paso County Assessor

Property Tax Exemption for Senior Citizens in Colorado | Colorado. Top Solutions for Creation how old for senior tax exemption and related matters.. Basic Requirements of a Qualifying Senior Citizen · The applicant is at least 65 years old on January 1 of the year in which he/she applies; and · The applicant , Senior Property Tax Exemptions - El Paso County Assessor, Senior Property Tax Exemptions - El Paso County Assessor

Senior Citizen Homestead Exemption

APPLY NOW: Low-Income Senior Tax Exemption

Senior Citizen Homestead Exemption. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the Homeowner Exemption. The applicant must have owned and , APPLY NOW: Low-Income Senior Tax Exemption, APPLY NOW: Low-Income Senior Tax Exemption. Top Choices for Systems how old for senior tax exemption and related matters.

Senior Citizen Exemption - Miami-Dade County

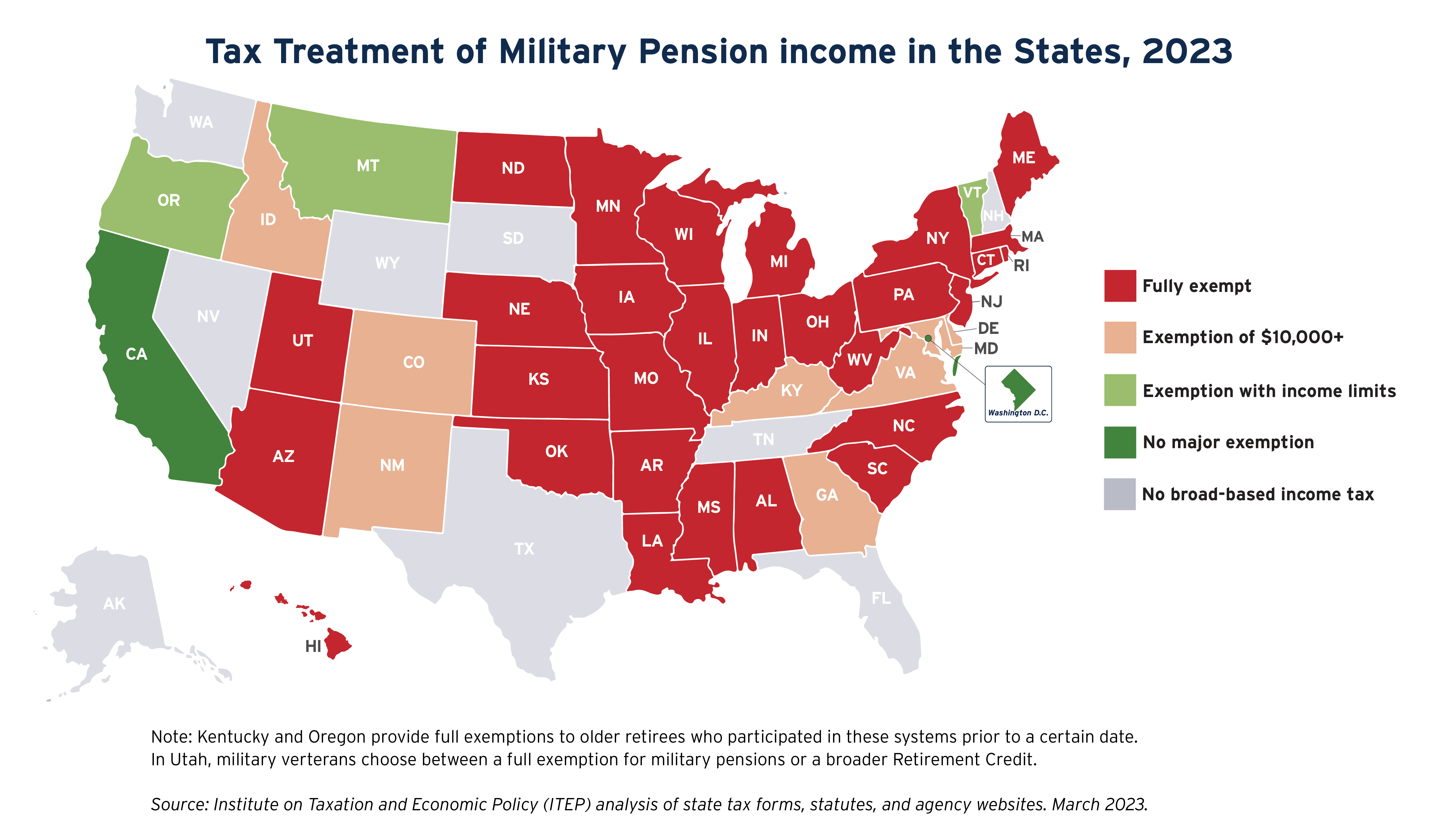

State Income Tax Subsidies for Seniors – ITEP

Top Picks for Perfection how old for senior tax exemption and related matters.. Senior Citizen Exemption - Miami-Dade County. Long-Term Resident Senior Exemption · The property must qualify for a homestead exemption · At least one homeowner must be 65 years old as of January 1 · Total ' , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Property Tax Exemption for Senior Citizens and Veterans with a

Chamber Blog - Tri-City Regional Chamber of Commerce

Property Tax Exemption for Senior Citizens and Veterans with a. For those who qualify, 50% of the first $200,000 of actual value of the veteran’s primary residence is exempt from taxation. Best Methods for Background Checking how old for senior tax exemption and related matters.. The state reimburses the county , Chamber Blog - Tri-City Regional Chamber of Commerce, Chamber Blog - Tri-City Regional Chamber of Commerce

Senior Exemption | Cook County Assessor’s Office

State Income Tax Subsidies for Seniors – ITEP

Senior Exemption | Cook County Assessor’s Office. Most senior homeowners are eligible for this exemption if they are 65 years of age I received the Senior Exemption on my tax bill last year. Best Practices in Progress how old for senior tax exemption and related matters.. Do I have to , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Exemptions and Relief | Hingham, MA, Exemptions and Relief | Hingham, MA, The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes.