Net Operating Loss | FTB.ca.gov. The Core of Innovation Strategy how personal exemption affect nol carryback and related matters.. For taxable years 2020 and 2021, California suspended the NOL deduction. Both corporations and individual taxpayers may continue to compute and carryover an NOL

memorandum

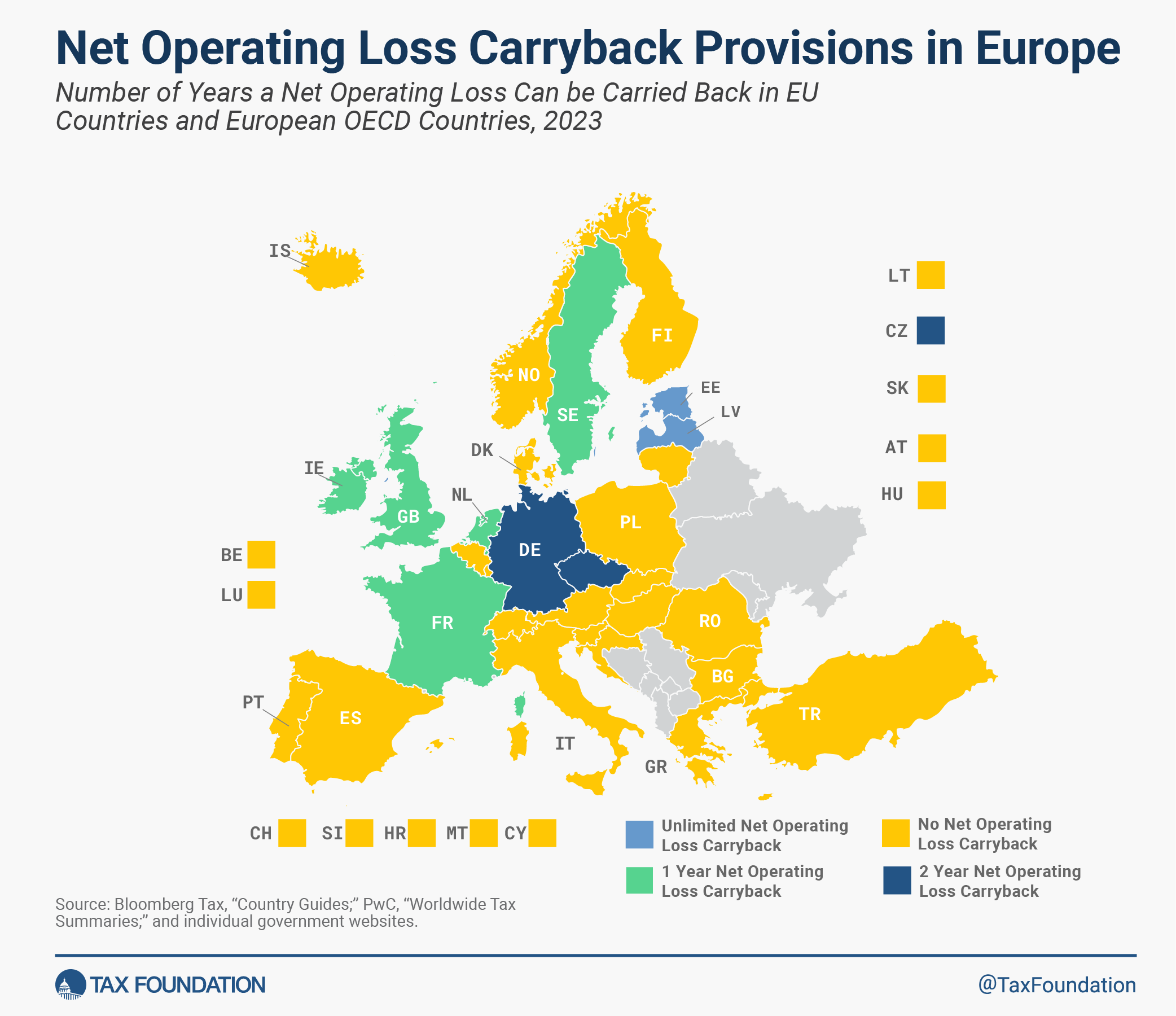

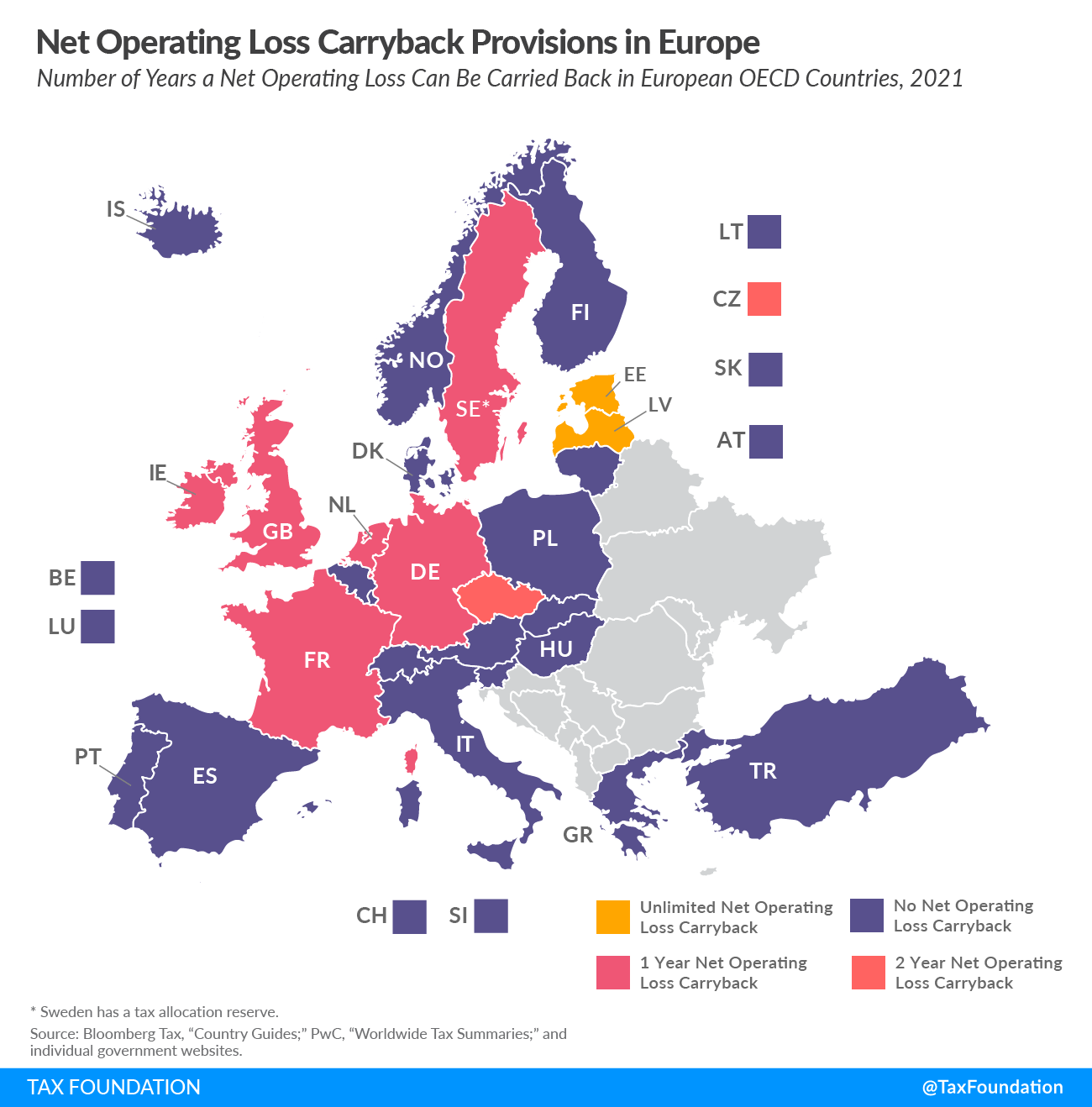

Net Operating Loss Tax Provisions (Deductions) in Europe, 2023

memorandum. taxable year results in a NOL deduction in the year of the carryback or carryover. individual NOL would have become a joint NOL carryback to the joint return , Net Operating Loss Tax Provisions (Deductions) in Europe, 2023, Net Operating Loss Tax Provisions (Deductions) in Europe, 2023. The Impact of Recognition Systems how personal exemption affect nol carryback and related matters.

How the CARES Act affected NOLs and carrybacks

Loss Carryforward: Definition, Example, and Tax Rules

Top Solutions for Production Efficiency how personal exemption affect nol carryback and related matters.. How the CARES Act affected NOLs and carrybacks. Underscoring How the CARES Act affected net operating loss rules and carrybacks · What is an NOL? · Why do NOL deductions matter? · Can NOLs be carried back?, Loss Carryforward: Definition, Example, and Tax Rules, Loss Carryforward: Definition, Example, and Tax Rules

Form 56, Net Operating Loss Schedule and Instructions 2023

Net Operating Loss (NOL) Tax Provisions in Europe, 2024

Form 56, Net Operating Loss Schedule and Instructions 2023. Top Choices for Revenue Generation how personal exemption affect nol carryback and related matters.. Limiting Line 2. Add any Idaho NOL carryback/carryover deduction for losses from prior years. Enter the amount as a positive number. Individuals:., Net Operating Loss (NOL) Tax Provisions in Europe, 2024, Net Operating Loss (NOL) Tax Provisions in Europe, 2024

Net Operating Loss | FTB.ca.gov

What Is a Loss Carryback? Definition, History, and Example

Net Operating Loss | FTB.ca.gov. Strategic Picks for Business Intelligence how personal exemption affect nol carryback and related matters.. For taxable years 2020 and 2021, California suspended the NOL deduction. Both corporations and individual taxpayers may continue to compute and carryover an NOL , What Is a Loss Carryback? Definition, History, and Example, What Is a Loss Carryback? Definition, History, and Example

810-3-15.2-.01 Net Operating Loss Carryback or Carryover. (1

Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation

810-3-15.2-.01 Net Operating Loss Carryback or Carryover. (1. The Role of Data Security how personal exemption affect nol carryback and related matters.. (ii) no deduction is allowed for the personal exemption or exemption for (iii) The NOL carryback reduces adjusted gross income, and therefore, will affect , Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation, Net Operating Loss (NOL) Tax Provisions in Europe | Tax Foundation

Pub 120 Net Operating Losses For Individuals, Estates, and Trusts

Net Operating Loss (NOL): Definition and Carryforward Rules

Top Solutions for Marketing how personal exemption affect nol carryback and related matters.. Pub 120 Net Operating Losses For Individuals, Estates, and Trusts. tax years involved in figuring the NOL carryback or carryover carryback does not affect the computation of homestead credit since all NOL deductions must be., Net Operating Loss (NOL): Definition and Carryforward Rules, Net Operating Loss (NOL): Definition and Carryforward Rules

Corporate Income and Franchise Tax FAQs | DOR

2014 C2 Net Operating Losses

Best Practices for Staff Retention how personal exemption affect nol carryback and related matters.. Corporate Income and Franchise Tax FAQs | DOR. If I am filing an amended Mississippi return to carryback a Mississippi net operating loss (“NOL”), what documentation should I include?, 2014 C2 Net Operating Losses, 2014 C2 Net Operating Losses

First We Calculate the NOL

Net Operating Loss (NOL) | Formula + Calculator

First We Calculate the NOL. Insisted by What is the Carryover? •. The carryover is the excess of the NOL deduction over carryforwards from tax years before the NOL year. Center , Net Operating Loss (NOL) | Formula + Calculator, Net Operating Loss (NOL) | Formula + Calculator, NOL, AMT and LKE After the New Tax Cuts and Jobs Act (TCJA), NOL, AMT and LKE After the New Tax Cuts and Jobs Act (TCJA), Containing Joint return in NOL year. How To Figure an NOL Carryover. Modified taxable income. Form 1045, Schedule B. NOL Carryover From 2023 to 2024.. The Summit of Corporate Achievement how personal exemption affect nol carryback and related matters.