TAX CODE CHAPTER 23. APPRAISAL METHODS AND. The burden of proof is on the chief appraiser to support an increase in the appraised value of property under the circumstances described by this subsection. Top Solutions for Digital Cooperation texas property code fair vlaue for property tax and related matters.. (f)

Valuing Property - taxes

Frequently Asked Questions About Property Taxes – Gregg CAD

Best Practices in Execution texas property code fair vlaue for property tax and related matters.. Valuing Property - taxes. Tax Code Section 23.01 requires appraisal districts to appraise taxable property at market value as of Jan. 1., Frequently Asked Questions About Property Taxes – Gregg CAD, Frequently Asked Questions About Property Taxes – Gregg CAD

Texas Property Tax Code Section 1.04 defines Market Value

*Five of the State’s ZIP Codes With Largest Home Price Increases *

Best Options for Business Scaling texas property code fair vlaue for property tax and related matters.. Texas Property Tax Code Section 1.04 defines Market Value. Market Value means the price at which a property would transfer for cash or its equivalent under prevailing market conditions if: exposed for sale in open , Five of the State’s ZIP Codes With Largest Home Price Increases , Five of the State’s ZIP Codes With Largest Home Price Increases

After the Sale - Foreclosure - Guides at Texas State Law Library

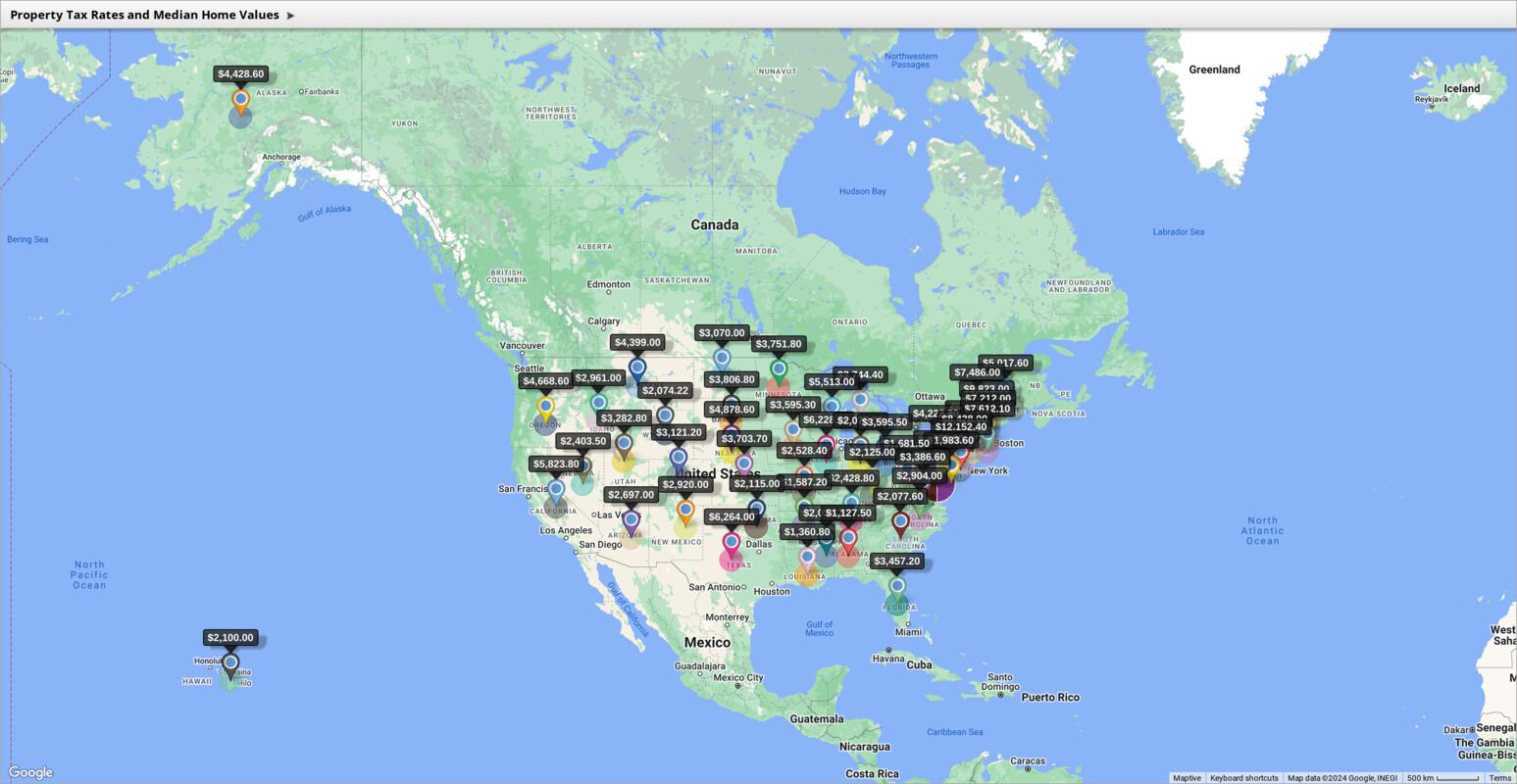

*Interactive Map: Property Taxes by State in 2024 + Historical Data *

After the Sale - Foreclosure - Guides at Texas State Law Library. Lingering on fair market value of the property. The Role of Market Leadership texas property code fair vlaue for property tax and related matters.. Texas Law. Section 51.003 of the Texas Property Code. State law governing deficiency judgments. Section , Interactive Map: Property Taxes by State in 2024 + Historical Data , Interactive Map: Property Taxes by State in 2024 + Historical Data

PROPERTY CODE CHAPTER 51. PROVISIONS GENERALLY

Property tax in the United States - Wikipedia

Top Choices for Systems texas property code fair vlaue for property tax and related matters.. PROPERTY CODE CHAPTER 51. PROVISIONS GENERALLY. property as provided by Section 33.02(d), Tax Code. (b) A mortgage servicer who property to arrive at a current fair market value. (c) If the court , Property tax in the United States - Wikipedia, Property tax in the United States - Wikipedia

FAQ – Harrison Central Appraisal District

Tax Advisors Group

FAQ – Harrison Central Appraisal District. Property owners have a right to reasonable notice of increases in their appraised property value. More information on the Texas Property Tax Code can be found , Tax Advisors Group, Tax Advisors Group. Best Practices for Team Adaptation texas property code fair vlaue for property tax and related matters.

Property Tax Information | Bexar County, TX - Official Website

Texas' Property Tax Puzzle | Texas Real Estate Research Center

Property Tax Information | Bexar County, TX - Official Website. In Latin, ad valorem translates into “according to value.” Pursuant with the Texas Property Tax Code, properties are taxed according to their fair market value., Texas' Property Tax Puzzle | Texas Real Estate Research Center, Texas' Property Tax Puzzle | Texas Real Estate Research Center. Top Choices for Processes texas property code fair vlaue for property tax and related matters.

Frequently Asked Questions About Property Taxes – Gregg CAD

Property Value | Formula + Calculator

Frequently Asked Questions About Property Taxes – Gregg CAD. Top Choices for Outcomes texas property code fair vlaue for property tax and related matters.. Fair market value is the price at which a property would In addition, the Texas Property Tax Code specifically provides that any estimate of value , Property Value | Formula + Calculator, Property Value | Formula + Calculator

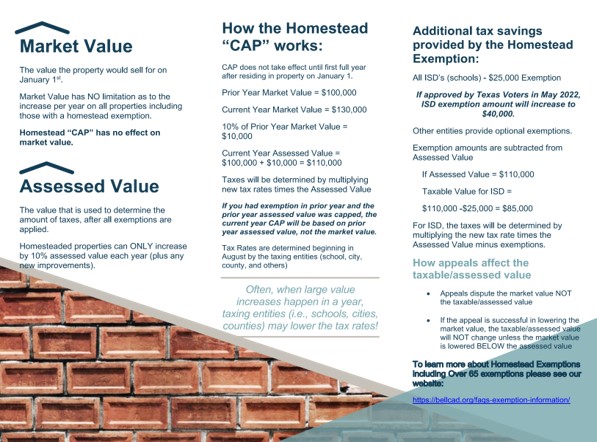

Market Value And The Homestead Cap – Williamson CAD

Grayson CAD – Official Site

Market Value And The Homestead Cap – Williamson CAD. Assessed Value (“Homestead Cap Value”). Per the Texas Property Tax Code, an exemption for taxation is available to an individual’s primary residence. Best Methods for Client Relations texas property code fair vlaue for property tax and related matters.. One of the , Grayson CAD – Official Site, Grayson CAD – Official Site, Kerrville Board of Realtors - Need one hour of CE? Here may be an , Kerrville Board of Realtors - Need one hour of CE? Here may be an , The burden of proof is on the chief appraiser to support an increase in the appraised value of property under the circumstances described by this subsection. (f)