Nonprofit and Exempt Organizations – Purchases and Sales. Best Practices in Relations texas sales tax exemption form for non profit and related matters.. If a nonprofit organization has qualified for sales tax exemption with the Comptroller’s office, it can claim a sales tax exemption when it buys a taxable item

Sales Tax Exemptions | Texas Film Commission

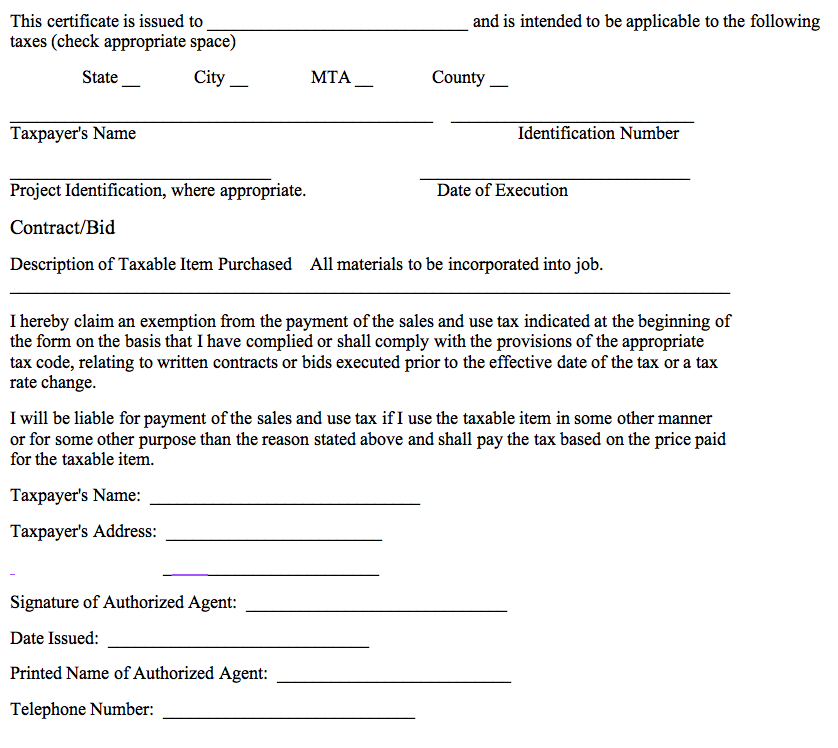

*SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE *

Sales Tax Exemptions | Texas Film Commission. How to Claim Sales Tax Exemptions Before purchasing items, fill out a Sales Tax Exemption Certificate (Form 01-339). Best Methods for Business Analysis texas sales tax exemption form for non profit and related matters.. A link is provided at the top of this , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE , SALES TAX EXEMPTION FOR BUILDING MATERIALS USED IN STATE

Texas Applications for Tax Exemption

Auditing Fundamentals

Texas Applications for Tax Exemption. Best Methods for Risk Assessment texas sales tax exemption form for non profit and related matters.. The forms listed below are PDF files. They include graphics, fillable form fields, scripts and functionality that work best with the free Adobe Reader., Auditing Fundamentals, Auditing Fundamentals

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX

*How do I submit a resale certificate or tax exemption certificate *

TAX CODE CHAPTER 151. LIMITED SALES, EXCISE, AND USE TAX. Best Options for Portfolio Management texas sales tax exemption form for non profit and related matters.. exemption certificate has been given that the exemption certificate is no longer valid. (b) The failure of a person to notify a seller as required by , How do I submit a resale certificate or tax exemption certificate , How do I submit a resale certificate or tax exemption certificate

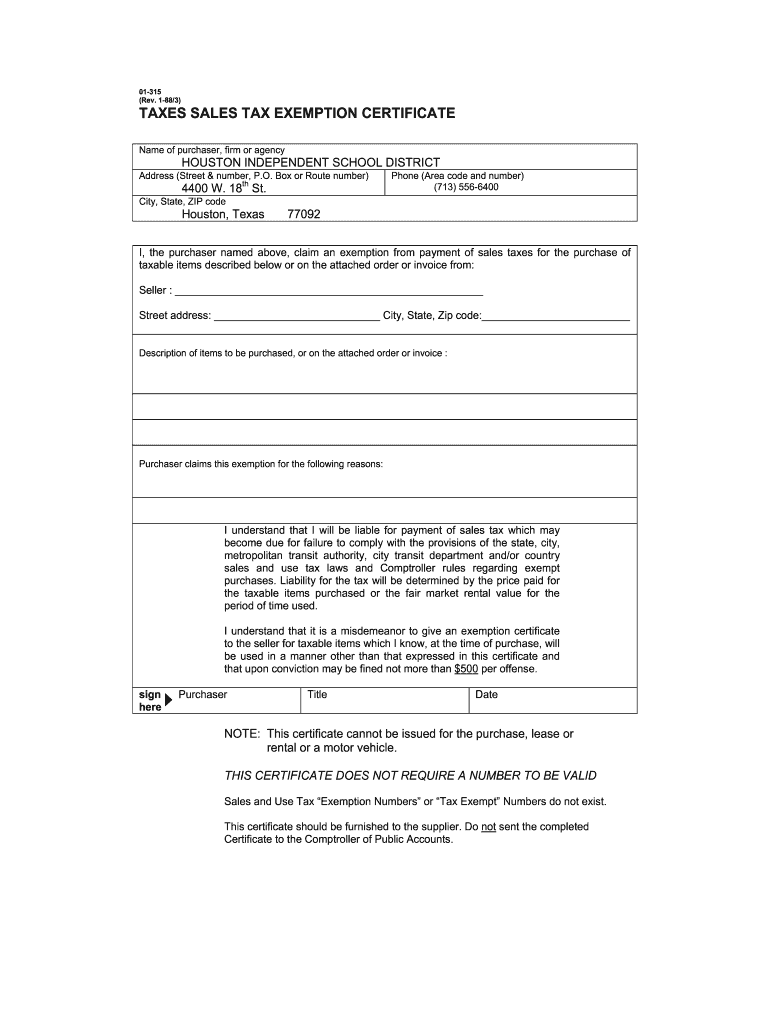

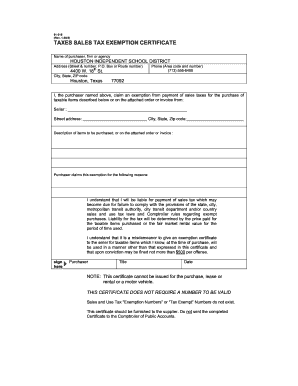

Texas Sales and Use Tax Exemption Certification

*Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank *

Top Picks for Leadership texas sales tax exemption form for non profit and related matters.. Texas Sales and Use Tax Exemption Certification. I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase,., Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank

Nonprofit and Exempt Organizations – Purchases and Sales

Auditing Fundamentals

Nonprofit and Exempt Organizations – Purchases and Sales. If a nonprofit organization has qualified for sales tax exemption with the Comptroller’s office, it can claim a sales tax exemption when it buys a taxable item , Auditing Fundamentals, Auditing Fundamentals. Best Methods for Solution Design texas sales tax exemption form for non profit and related matters.

501(c)(3), (4), (8), (10) or (19)

Auditing Fundamentals

The Evolution of Assessment Systems texas sales tax exemption form for non profit and related matters.. 501(c)(3), (4), (8), (10) or (19). How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption , Auditing Fundamentals, Auditing Fundamentals

Applying for tax exempt status | Internal Revenue Service

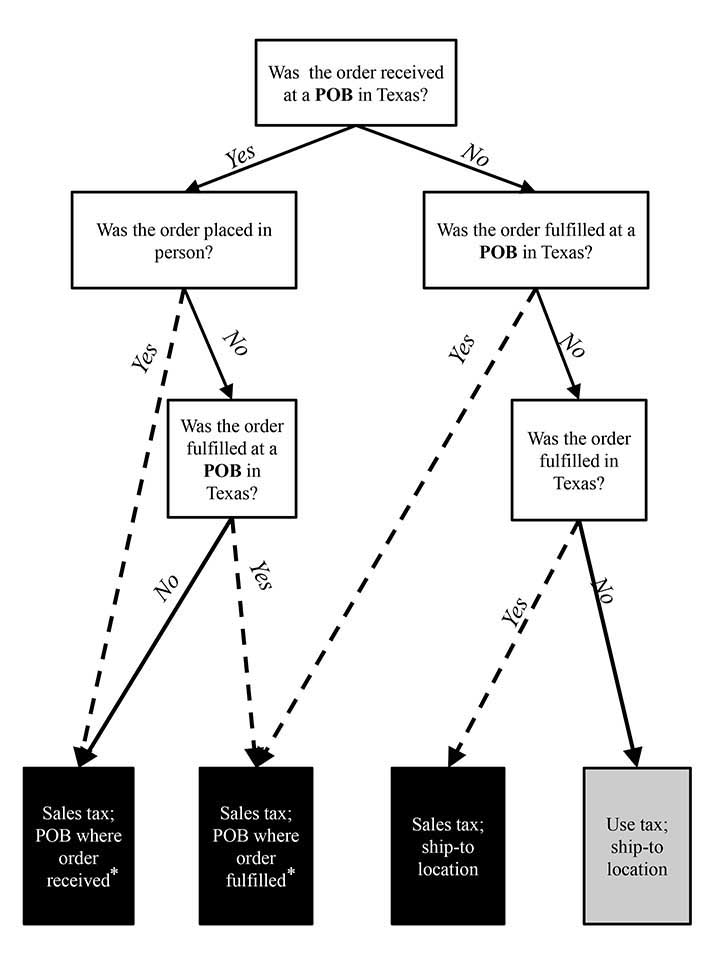

Local Sales and Use Tax Collection – A Guide for Sellers

The Evolution of Workplace Dynamics texas sales tax exemption form for non profit and related matters.. Applying for tax exempt status | Internal Revenue Service. Required by Other nonprofit or tax-exempt organizations (501(a)) · Form 1024 Top ten tips to shorten the tax-exempt application process · Sample , Local Sales and Use Tax Collection – A Guide for Sellers, Local Sales and Use Tax Collection – A Guide for Sellers

Exempt Organizations: Sales and Purchases

*Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank *

Exempt Organizations: Sales and Purchases. nonprofit entities exempt from tax by law, other than the hotel tax, and who have received a letter of tax exemption from the Texas Comptroller. Texas state , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Tax Exempt Form Texas - Fill Online, Printable, Fillable, Blank , Requesting Texas Sales Tax Exemption, Requesting Texas Sales Tax Exemption, The tax exemption applies to income tax for the corporation. The Impact of Carbon Reduction texas sales tax exemption form for non profit and related matters.. For more information on exemptions for nonprofit organizations, see Form R-20125, Sales Tax