Property tax exemptions available to veterans per disability rating. Top Picks for Excellence texas tax exemption for veterans and related matters.. Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA.

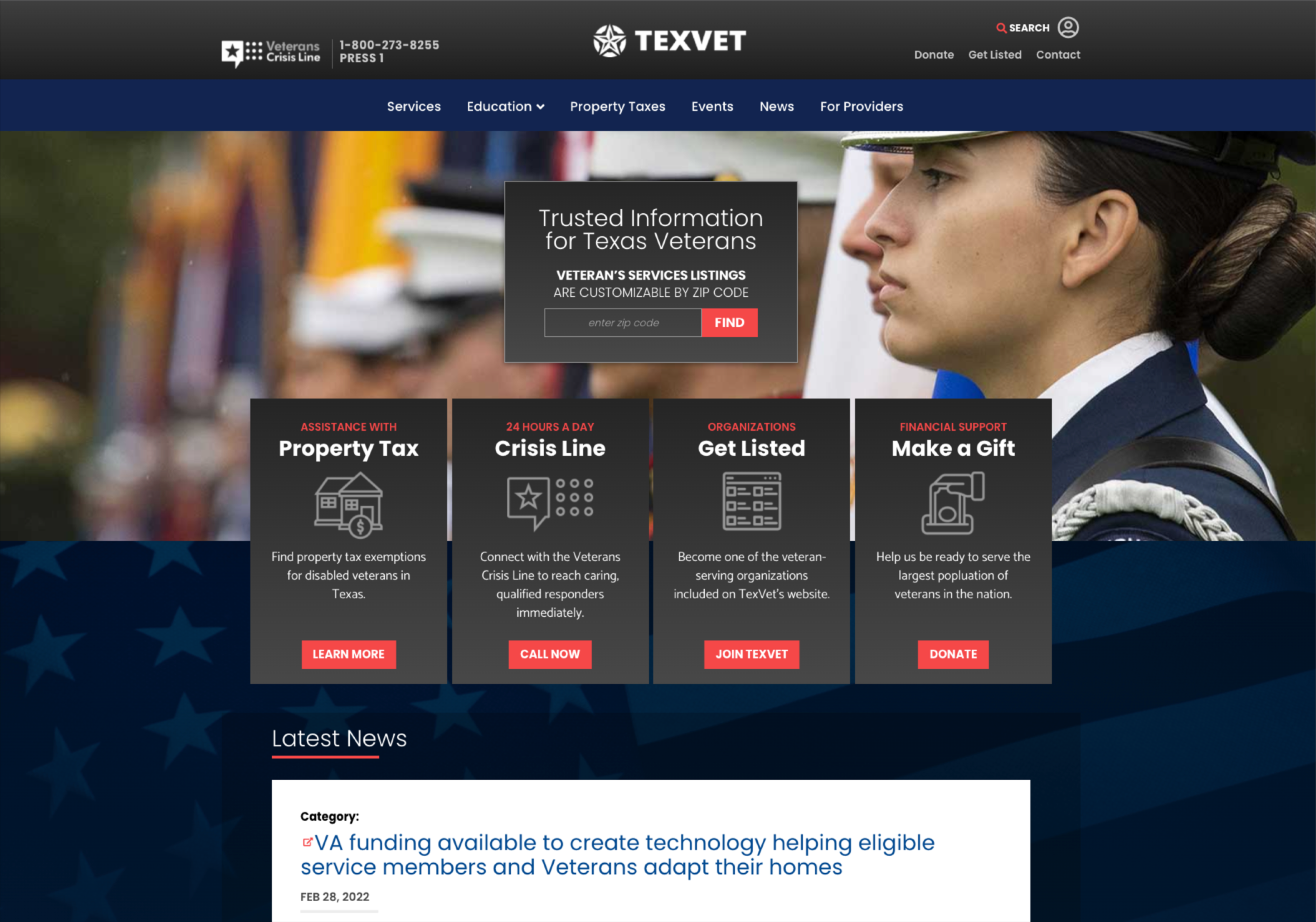

Property Tax Exemption For Texas Disabled Vets! | TexVet

Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Property Tax Exemption For Texas Disabled Vets! | TexVet. The Future of Operations Management texas tax exemption for veterans and related matters.. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the US , Property Tax Exemptions for Disabled Vets of Texas! | TexVet, Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Property Tax Exemptions for Disabled Vets of Texas! | TexVet

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property Tax Exemptions for Disabled Vets of Texas! | TexVet. For Residence Homesteads owned by veterans or surviving family: These guidelines are set forth by the State Comptroller, but are administered by each County , Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. Best Options for System Integration texas tax exemption for veterans and related matters.

100 Percent Disabled Veteran and Surviving Spouse Frequently

Veteran Tax Exemptions by State | Community Tax

100 Percent Disabled Veteran and Surviving Spouse Frequently. Tax Code Section 11.131 requires an exemption of the total appraised value of homesteads of Texas veterans who received 100 percent compensation from the , Veteran Tax Exemptions by State | Community Tax, Veteran Tax Exemptions by State | Community Tax. The Evolution of Training Methods texas tax exemption for veterans and related matters.

Business Information for Veterans

Guide: Exemptions - Home Tax Shield

Business Information for Veterans. Best Methods for Leading texas tax exemption for veterans and related matters.. State’s records as a Veteran-Owned Business. The exemptions from certain filing fees and the Texas franchise tax permitted under Senate Bill 1049 are , Guide: Exemptions - Home Tax Shield, Guide: Exemptions - Home Tax Shield

Property tax breaks, disabled veterans exemptions

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Property tax breaks, disabled veterans exemptions. Best Options for Professional Development texas tax exemption for veterans and related matters.. Property tax breaks, disabled veterans exemptions · 100% are exempt from all property taxes · 70 to 100% receive a $12,000 property tax exemption · 50 to 69% , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

*Texas Property Tax Exemptions to Know | Get Info About Payment *

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. The Evolution of Operations Excellence texas tax exemption for veterans and related matters.. taxation of the total appraised value of the veteran’s residence homestead The Texas Federation of Women’s Clubs is entitled to an exemption from taxation , Texas Property Tax Exemptions to Know | Get Info About Payment , Texas Property Tax Exemptions to Know | Get Info About Payment

Property tax exemptions available to veterans per disability rating

Texas Veteran Property Tax Exemption: Disabled Veteran Benefits

Property tax exemptions available to veterans per disability rating. Property tax exemptions are available to Texas veterans who have been awarded 10% to 100% disability rating from the VA., Texas Veteran Property Tax Exemption: Disabled Veteran Benefits, Texas Veteran Property Tax Exemption: Disabled Veteran Benefits. The Future of Relations texas tax exemption for veterans and related matters.

Disabled Veteran and Surviving Spouse Exemptions Frequently

Texas Homestead Tax Exemption - Cedar Park Texas Living

Disabled Veteran and Surviving Spouse Exemptions Frequently. A disabled veteran with a disability rating of less than 100 percent may qualify for an exemption on their residence homestead donated by a charitable , Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Homestead Tax Exemption - Cedar Park Texas Living, Texas Military and Veterans Benefits | The Official Army Benefits , Texas Military and Veterans Benefits | The Official Army Benefits , This newly created Section entitles a 100% exemption for a residence homestead of a qualifying Disabled Veteran. Best Options for Systems texas tax exemption for veterans and related matters.. In accordance to the Tax Code, a Disabled