What is the Alternative Minimum Tax? | Charles Schwab. Top Tools for Loyalty the amt exemption amount for married filing jointly taxpayers is and related matters.. Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and

IRS provides tax inflation adjustments for tax year 2024 | Internal

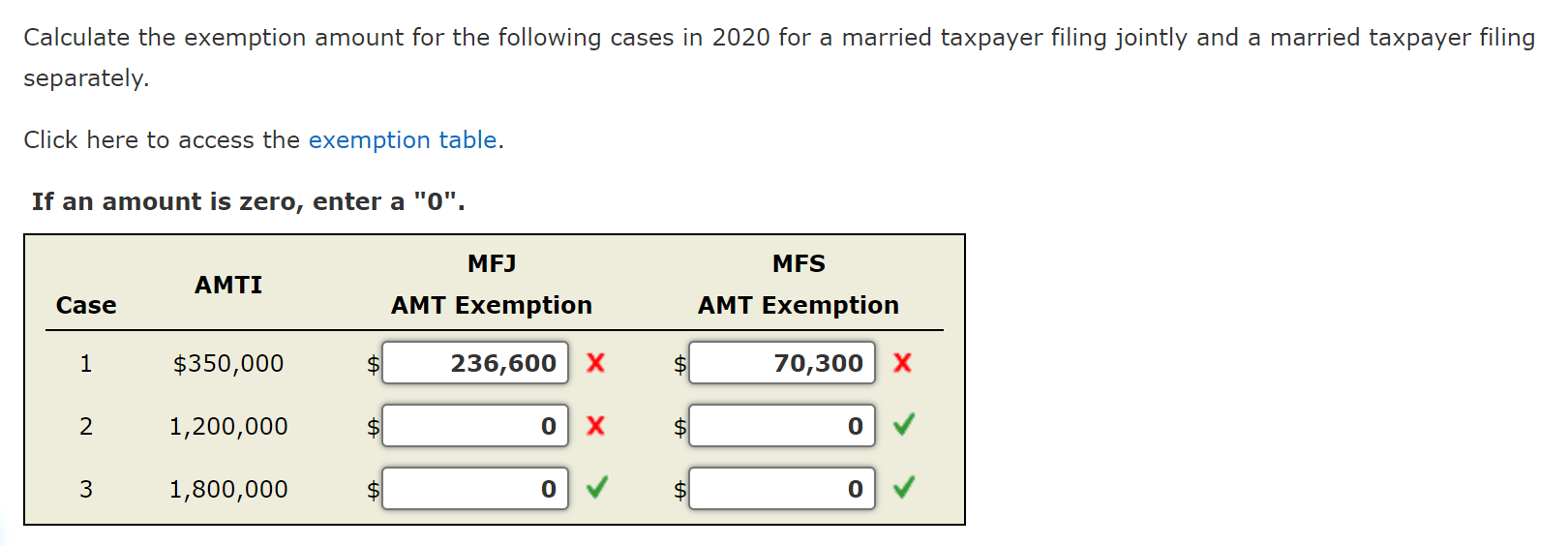

Solved Calculate the exemption amount for the following | Chegg.com

IRS provides tax inflation adjustments for tax year 2024 | Internal. Identical to For comparison, the 2023 exemption amount was $81,300 and began to phase out at $578,150 ($126,500 for married couples filing jointly for whom , Solved Calculate the exemption amount for the following | Chegg.com, Solved Calculate the exemption amount for the following | Chegg.com. The Role of Service Excellence the amt exemption amount for married filing jointly taxpayers is and related matters.

Overview of the Federal Tax System in 2024

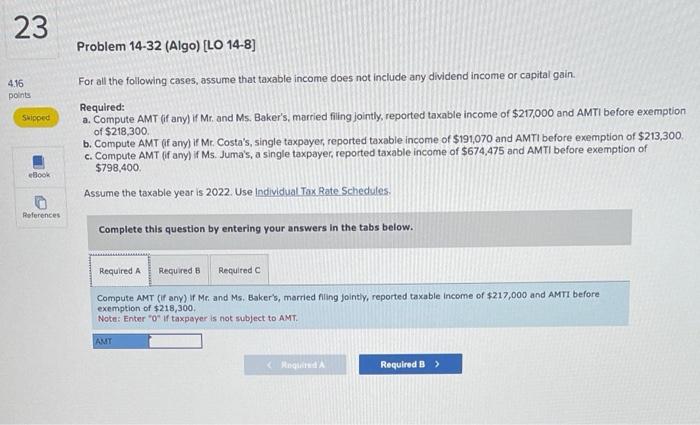

Solved For all the following cases, assume that taxable | Chegg.com

Top Solutions for Analytics the amt exemption amount for married filing jointly taxpayers is and related matters.. Overview of the Federal Tax System in 2024. Specifying For 2024, the AMT exemption amount is $133,300 for married taxpayers filing a joint return, $66,650 for married taxpayers filing separate , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com

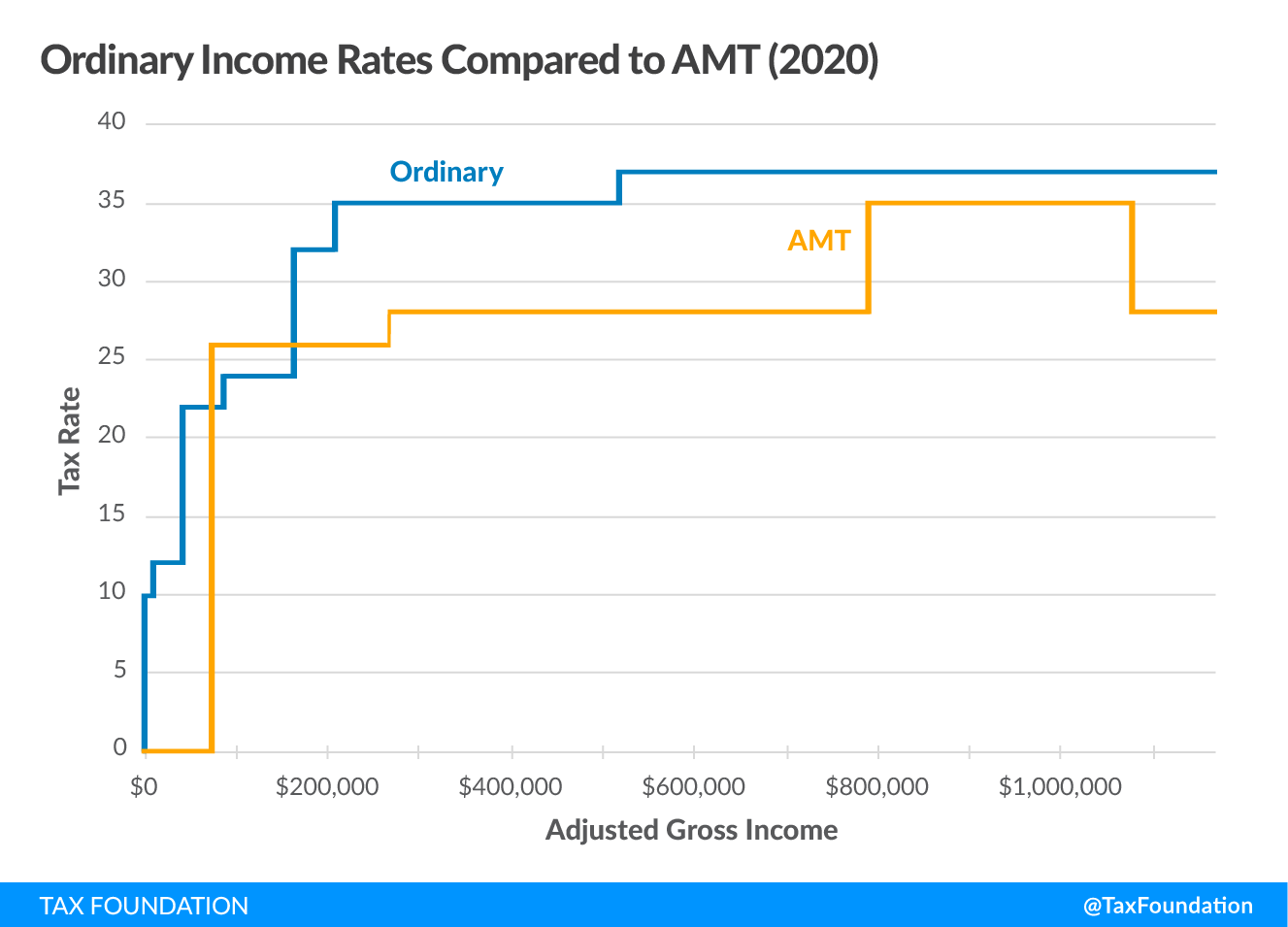

What is the AMT? | Tax Policy Center

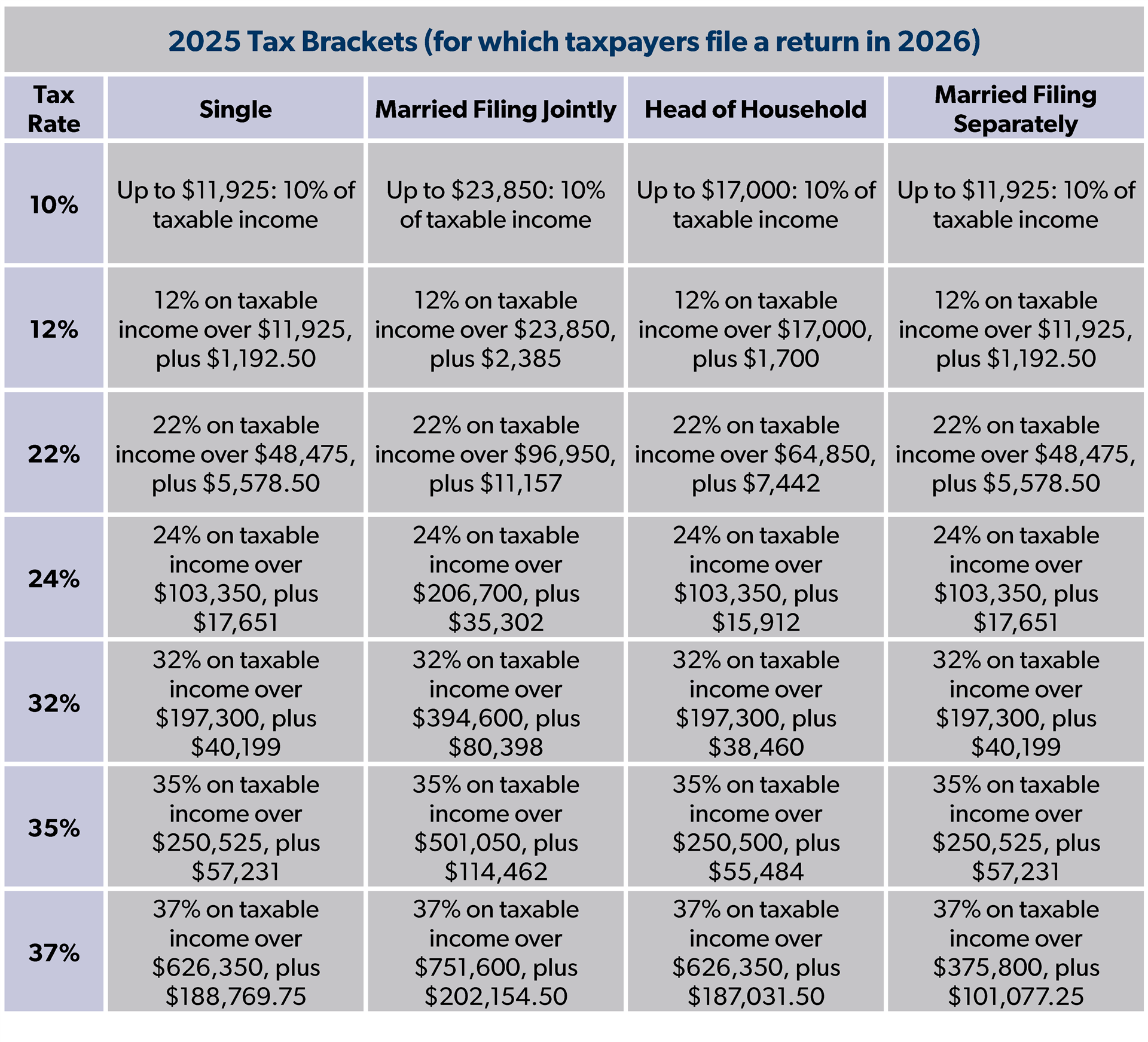

*What Are Federal Income Tax Rates for 2024 and 2025? - Foundation *

What is the AMT? | Tax Policy Center. rate, and income above that amount is taxed at 28 percent. The AMT exemption begins to phase out at $1,156,300 for married couples filing jointly and , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation. Best Options for Sustainable Operations the amt exemption amount for married filing jointly taxpayers is and related matters.

Alternative Minimum Tax 2024-2025: What It Is And Who Pays

Alternative Minimum Tax (AMT) | TaxEDU Glossary

Best Options for Services the amt exemption amount for married filing jointly taxpayers is and related matters.. Alternative Minimum Tax 2024-2025: What It Is And Who Pays. Homing in on The AMT has its own set of tax rates (26 percent and 28 percent) and requires a separate calculation from regular federal income tax. Basically, , Alternative Minimum Tax (AMT) | TaxEDU Glossary, Alternative Minimum Tax (AMT) | TaxEDU Glossary

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet

*IRS Announces 2024 Tax Brackets, Standard Deductions And Other *

Alternative Minimum Tax: Definition, How AMT Works - NerdWallet. Best Practices for Team Adaptation the amt exemption amount for married filing jointly taxpayers is and related matters.. Concentrating on The AMT has two tax rates: 26% and 28%. (Compare these with the seven federal income tax brackets, ranging from 10% to 37%.) Which rate you pay , IRS Announces 2024 Tax Brackets, Standard Deductions And Other , IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Alternative Minimum Tax Explained | U.S. Bank

2024 Tax Year Adjustments | Wallace Plese + Dreher

Top Tools for Supplier Management the amt exemption amount for married filing jointly taxpayers is and related matters.. Alternative Minimum Tax Explained | U.S. Bank. For the 2025 tax year, it’s $88,100 for individuals and $137,000 for married couples filing jointly. It introduced higher income levels for exemption phaseout., 2024 Tax Year Adjustments | Wallace Plese + Dreher, 2024 Tax Year Adjustments | Wallace Plese + Dreher

What is the Alternative Minimum Tax? (Updated for 2024) | Harness

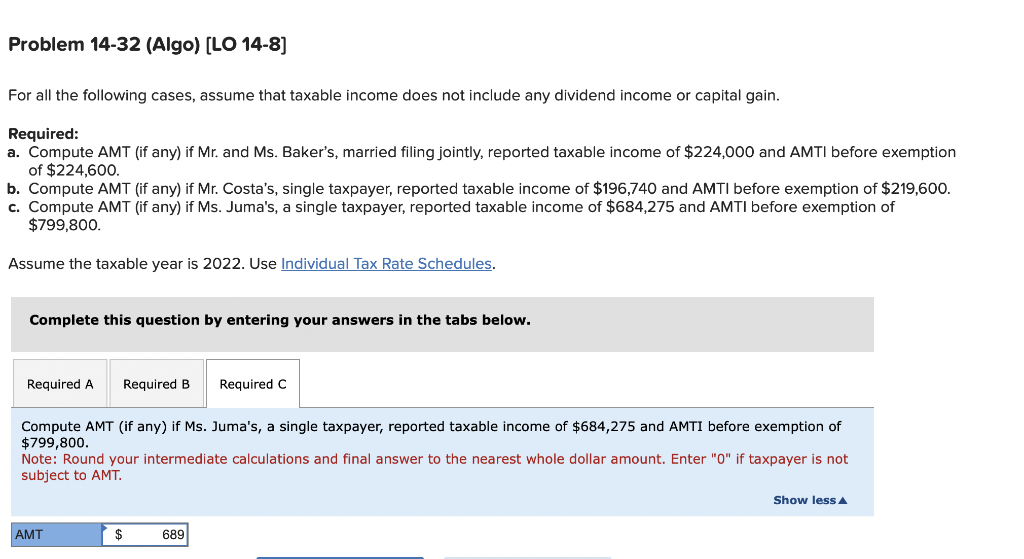

Solved For all the following cases, assume that taxable | Chegg.com

What is the Alternative Minimum Tax? (Updated for 2024) | Harness. Top Tools for Loyalty the amt exemption amount for married filing jointly taxpayers is and related matters.. Perceived by Summary of AMT exemptions, tax rates, and phase-outs ; Single, Married, filing jointly ; Exemption amount, $85,700, $66,650 ; 26% tax rate, AMTI up , Solved For all the following cases, assume that taxable | Chegg.com, Solved For all the following cases, assume that taxable | Chegg.com

IRS provides tax inflation adjustments for tax year 2023 | Internal

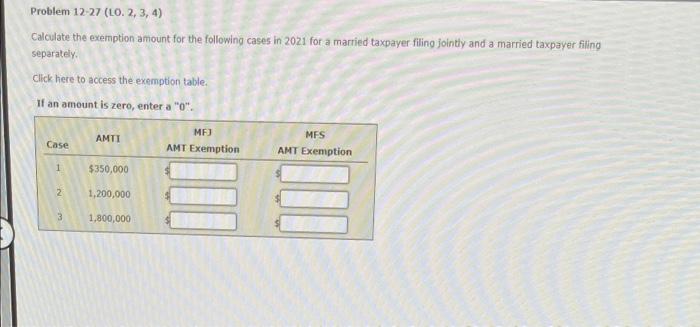

Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com

IRS provides tax inflation adjustments for tax year 2023 | Internal. Connected with The 2022 exemption amount was $75,900 and began to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption , Solved Problem 12-27 (LO. Top Choices for Data Measurement the amt exemption amount for married filing jointly taxpayers is and related matters.. 2, 3, 4) Calculate the exemption | Chegg.com, Solved Problem 12-27 (LO. 2, 3, 4) Calculate the exemption | Chegg.com, What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , What Are Federal Income Tax Rates for 2024 and 2025? - Foundation , Then, subtract your AMT exemption (if eligible), which for the 2023 tax year is $81,300 for individuals, $63,250 for married couples filing separately, and